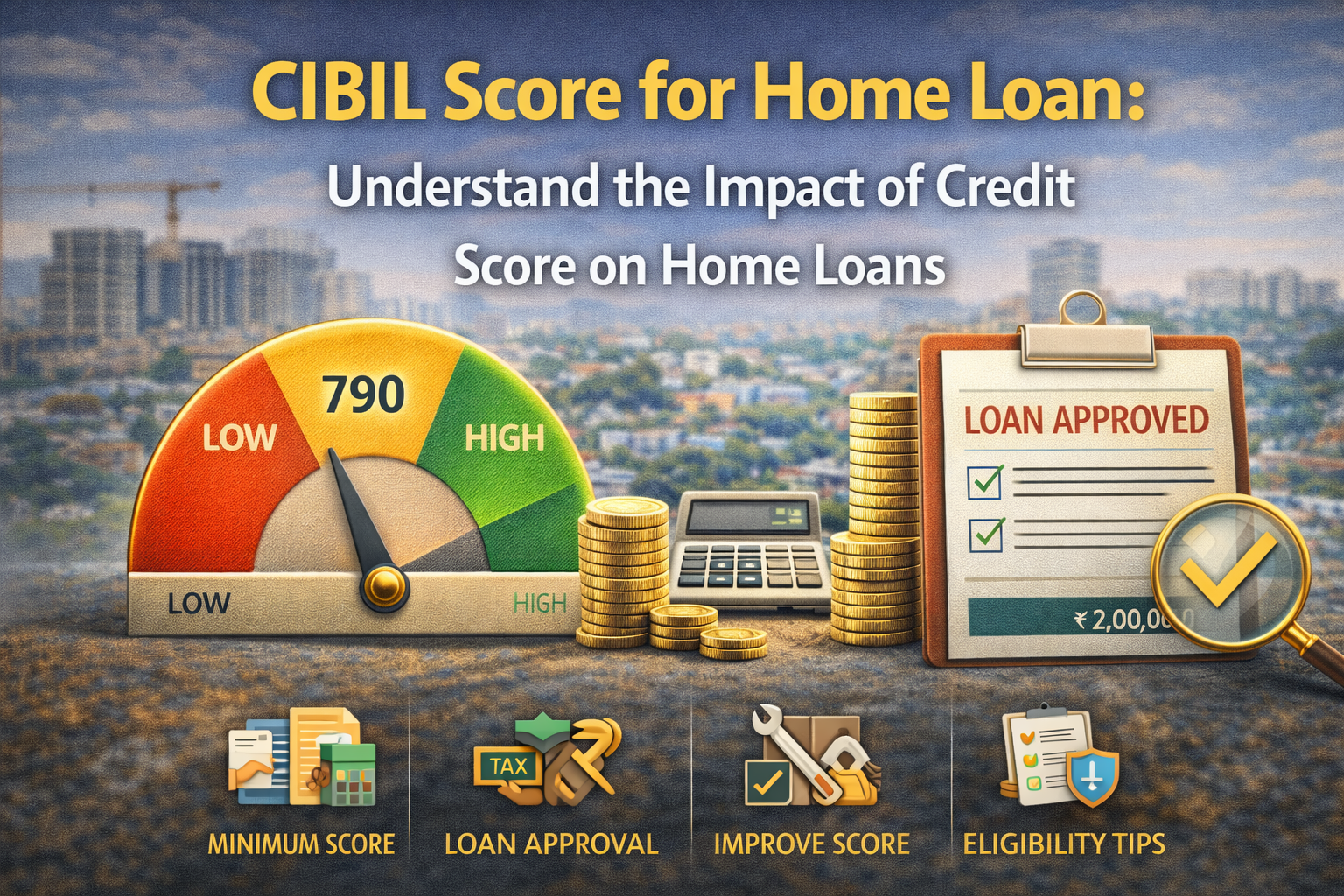

CIBIL Score for Home Loan: How Your Credit Score Impacts Eligibility, EMI & Interest Rates

Buying a home is one of the biggest financial decisions of your life. While income, property value, and down payment matter, your CIBIL score plays a decisive role in whether your home loan gets approved and on what terms. A strong credit score can help you secure lower interest rates, higher loan amounts, and faster …