Buying a home is one of the biggest financial decisions for most Indians. For many first-time buyers, a home loan is the only practical way to turn this dream into reality. However, home loan rejection is more common than people expect and often comes as a shock to applicants who believe their income or job profile is strong.

What makes this situation more difficult is that lenders are not legally required to disclose the exact reason for rejecting a home loan application. This leaves borrowers confused and unsure about what went wrong.

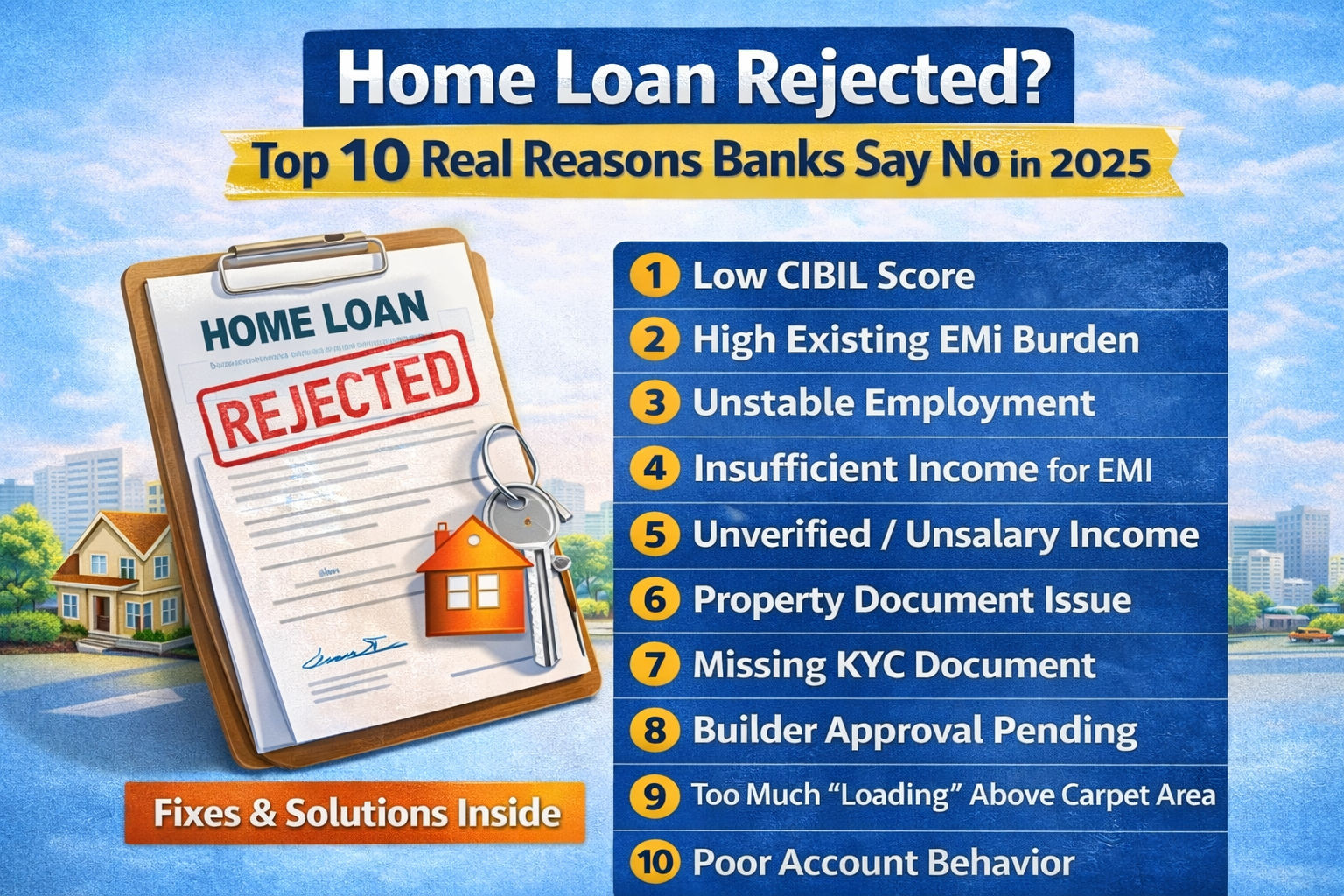

Understanding the reasons for home loan rejection is therefore crucial. It helps you correct mistakes, improve eligibility, and reapply with confidence either with the same lender or a different one.

This article explains what causes home loan rejection in India, why lenders reject applications, and how you can avoid these issues. The explanations are kept simple and practical, assuming you are a first-time borrower.

Index

- How Home Loan Approval Works in Simple Terms

- 1. Incomplete or Incorrect Documentation

- 2. Poor or Low Credit Score

- 3. Failure to Meet Home Loan Eligibility Criteria

- 4. Past Loan Defaults or Irregular Repayment History

- 5. High Existing Debt or Loan Obligations

- 6. Property or Builder Not Approved by the Lender

- 7. Low Property Valuation by the Lender

- 8. Age-Related Concerns

- 9. Multiple Loan Enquiries in a Short Time

- Impact of Home Loan Rejection on Borrowers

- How to Improve Your Chances Before Reapplying

- Expert Conclusion

- Frequently Asked Questions (FAQs)

How Home Loan Approval Works in Simple Terms

Before discussing rejection reasons, it is important to understand how lenders evaluate a home loan application.

Banks and housing finance companies assess your application on three broad factors:

- Borrower profile – income, job stability, age, credit score, repayment history

- Loan eligibility – EMI affordability, existing loans, tenure, co-applicant strength

- Property details – legal status, builder approval, valuation, age of property

A rejection can happen if any one of these areas raises a red flag, even if everything else looks fine.

1. Incomplete or Incorrect Documentation

Why this leads to rejection

Documents are the foundation of your home loan application. Lenders rely on them to verify your identity, income, employment, address, and property details.

If documents are:

- Missing

- Inconsistent

- Incorrectly filled

- Poorly scanned or illegible

the lender may treat the application as high risk and reject it.

Common documentation mistakes

- Name mismatch across PAN, Aadhaar, and application form

- Different signatures on loan form and KYC documents

- Incorrect address or spelling errors

- Missing income proof (salary slips, Form 16, ITR)

- Incomplete property papers

Even small clerical errors can delay processing or lead to outright rejection.

How to avoid this

- Cross-check every document before submission

- Ensure signatures match exactly

- Use the same name format across all documents

- Submit clear, readable copies

- Provide all documents requested by the lender

2. Poor or Low Credit Score

What is a credit score?

A credit score is a numerical summary of your credit behaviour. In India, it usually ranges from 300 to 900 and is issued by credit bureaus like CIBIL, Experian, and Equifax.

Minimum credit score for home loans

Most lenders prefer a credit score of 700 or above for home loan approval. A score below this indicates higher risk.

Why low credit score leads to rejection

A low credit score suggests:

- Past payment delays

- Loan or credit card defaults

- High credit utilisation

- Multiple recent loan enquiries

Even if your current income is high, lenders may reject your application if your credit history is weak.

How to improve your credit score

- Pay all EMIs and credit card bills on time

- Clear outstanding dues

- Avoid multiple loan applications at once

- Check your credit report for errors and get them corrected

- Maintain low credit card utilisation

3. Failure to Meet Home Loan Eligibility Criteria

What is home loan eligibility?

Eligibility refers to whether you meet the lender’s requirements related to:

- Income level

- Age

- Job type

- Work experience

- EMI affordability

Each lender has its own eligibility rules.

Common eligibility-related rejection reasons

- Income too low for the requested loan amount

- EMI exceeds allowed percentage of income

- Applicant nearing retirement age

- Insufficient work experience

- Unstable income pattern

Employment stability matters

Lenders prefer:

- Salaried employees with at least 2–3 years of total experience

- Self-employed individuals with consistent income for 2–3 years

Frequent job changes, contractual roles, seasonal businesses, or short work history can increase rejection risk.

4. Past Loan Defaults or Irregular Repayment History

Why past defaults matter

Even a single past default can significantly impact your loan approval chances. Lenders see defaults as a sign of poor financial discipline.

Examples of past defaults

- Missed credit card payments

- Settled or written-off loans

- Old unpaid dues you were unaware of

- Skipped EMIs during financial stress

Sometimes applicants assume old issues no longer matter, but lenders consider entire credit history, not just recent behaviour.

What you should do

- Check your credit report before applying

- Clear all pending dues

- Avoid settlements if possible; aim for full repayment

- Wait a few months after clearing dues before reapplying

5. High Existing Debt or Loan Obligations

How lenders look at existing loans

Lenders calculate your Fixed Obligation to Income Ratio (FOIR). This is the percentage of your monthly income already committed to EMIs.

If your existing EMIs are too high, lenders may feel you cannot comfortably handle another loan.

Common issues

- Multiple personal loans

- High credit card outstanding

- Ongoing car or education loans

- Acting as a guarantor for someone else’s loan

How to reduce rejection risk

- Prepay or close smaller loans

- Reduce credit card balances

- Avoid taking new loans before applying for a home loan

- Consider adding a co-applicant to improve eligibility

6. Property or Builder Not Approved by the Lender

Why property approval matters

Home loans are secured loans. The property itself is the lender’s security.

If the property:

- Has legal issues

- Is constructed without approvals

- Is built by a blacklisted builder

the lender may reject the loan, regardless of your income or credit score.

Common property-related problems

- Land title disputes

- Missing occupancy or completion certificate

- Property not registered correctly

- Builder not approved by the lender

- Under-construction project with delayed approvals

What you should do

- Choose projects approved by multiple banks

- Ask the lender for a list of approved builders

- Verify legal documents through a property lawyer

- Avoid cash transactions in property deals

7. Low Property Valuation by the Lender

What is property valuation?

Lenders conduct an independent valuation to estimate the fair market value of the property.

Why valuation can cause rejection

Even if you are eligible for a higher loan:

- The lender may value the property lower than the purchase price

- Loan amount is calculated as a percentage of valuation, not agreement value

If the gap is large, the lender may:

- Reduce the loan amount

- Ask for higher down payment

- Reject the application

Common reasons for low valuation

- Older property

- Poor construction quality

- Unfavourable location

- Overpriced deal

8. Age-Related Concerns

Why age matters

Lenders prefer the loan to be fully repaid before retirement.

Possible issues

- Applicant too close to retirement

- Long tenure not possible due to age limit

- Insufficient earning years left

Solution

- Opt for a shorter tenure

- Add a younger co-applicant

- Increase down payment to reduce loan amount

9. Multiple Loan Enquiries in a Short Time

How this affects your application

Each loan enquiry is recorded in your credit report. Too many enquiries in a short period indicate credit hunger.

Why lenders see this negatively

- Suggests financial stress

- Indicates desperation for credit

- Lowers credit score slightly

Best practice

- Avoid applying to multiple lenders simultaneously

- Use eligibility calculators before applying

- Apply only when you are reasonably confident

Impact of Home Loan Rejection on Borrowers

Home loan rejection can have both immediate and long-term effects:

- Delays in property purchase

- Loss of booking amount in some cases

- Emotional stress and uncertainty

- Lower confidence in future applications

- Temporary drop in credit score due to enquiries

Understanding the reasons early helps minimise these impacts.

How to Improve Your Chances Before Reapplying

If your home loan was rejected, consider these steps:

- Review your credit report in detail

- Correct documentation errors

- Reduce existing debts

- Improve credit score over 3–6 months

- Choose an approved property

- Add a financially strong co-applicant

A well-prepared application significantly improves approval chances.

Expert Conclusion

Home loan rejection is rarely random. It usually results from gaps in credit profile, eligibility, documentation, or property compliance.

By understanding why lenders reject home loan applications, borrowers can take corrective action instead of making repeated mistakes. Preparing in advance—checking credit score, choosing the right property, managing debts, and submitting accurate documents—can greatly increase approval chances.

A home loan is a long-term financial commitment. Taking time to strengthen your application is always better than rushing and facing rejection.

Frequently Asked Questions (FAQs)

1. What is the most common reason for home loan rejection in India?

Poor credit score and incomplete documentation are among the most common reasons for rejection.

2. Can a home loan be rejected even with a high salary?

Yes. High income alone does not guarantee approval. Credit history, existing loans, and property details also matter.

3. Does one missed EMI lead to home loan rejection?

A single minor delay may not cause rejection, but repeated delays or defaults can significantly reduce approval chances.

4. Can I apply again after home loan rejection?

Yes. You can reapply after correcting the issues that led to rejection, either with the same lender or another one.

5. How long should I wait before reapplying?

Ideally, wait 3–6 months after improving your credit score or reducing liabilities.

6. Will applying with a co-applicant improve approval chances?

Yes. A co-applicant with stable income and good credit can improve eligibility and approval chances.

7. Can a home loan be rejected due to property issues alone?

Yes. Even if the borrower is eligible, property-related legal or valuation issues can lead to rejection.

8. Do banks inform the exact reason for rejection?

No. Banks are not legally required to disclose the specific reason for home loan rejection.