Tax Deducted at Source (TDS) is one of the most important concepts in India’s income tax system. Every year, the government revises TDS rates, thresholds, and compliance rules to improve tax collection and reduce unnecessary deductions.

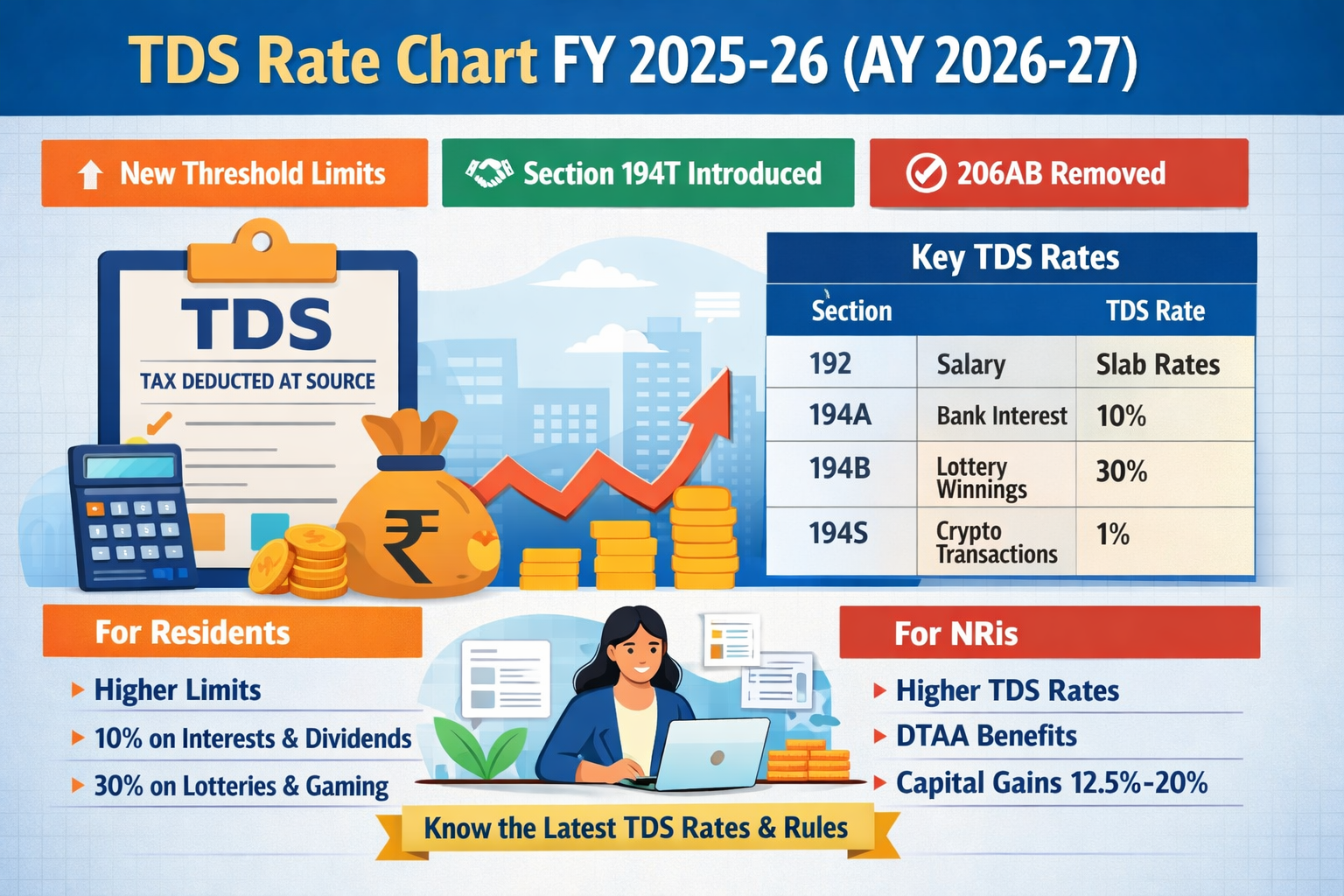

For FY 2025–26 (Assessment Year 2026–27), several threshold limits have been increased, a new TDS section has been introduced, and some compliance-heavy provisions have been removed. These changes directly affect salaried employees, senior citizens, freelancers, contractors, investors, business owners, and NRIs.

This guide explains the latest TDS rate chart for FY 2025–26 in a clear, structured, and practical manner so you know when TDS applies, at what rate, and how it impacts you.

Index

What is TDS and Why It Matters

TDS means tax deducted at the time of payment, instead of collecting tax at the end of the year.

It serves three key purposes:

- Ensures regular tax collection for the government

- Reduces tax evasion

- Helps taxpayers spread tax liability across the year

TDS is deducted on income such as:

- Salary

- Interest

- Rent

- Commission

- Professional fees

- Contract payments

- Capital transactions

- Digital asset transfers

The deducted tax appears in Form 26AS / AIS and can be adjusted against your final tax liability while filing your Income Tax Return (ITR).

What’s New in TDS for FY 2025–26

Before looking at the rate charts, it’s important to understand what has changed from 1 April 2025.

Key Highlights

- Higher threshold limits for many sections (less TDS for small taxpayers)

- Section 206AB removed (no automatic higher TDS for non-filers)

- New Section 194T introduced for partner remuneration

- Reduced TDS rate on securitisation trust income for residents

- Simplified compliance for individuals and small businesses

These changes aim to reduce unnecessary deductions and compliance burden.

TDS Rates for Residents – FY 2025–26

Below is the updated and consolidated TDS rate chart for residents, applicable from 1 April 2025.

Common TDS Sections and Rates (Residents)

| Section | Nature of Income | Threshold Limit | TDS Rate |

|---|---|---|---|

| 192 | Salary | Basic exemption limit | Slab rates |

| 192A | EPF premature withdrawal | ₹50,000 | 10% |

| 193 | Interest on securities | ₹10,000 | 10% |

| 194 | Dividend | ₹10,000 | 10% |

| 194A | Bank/Post Office interest | ₹50,000 | 10% |

| 194A | Senior citizen interest | ₹1,00,000 | 10% |

| 194K | Mutual fund dividend | ₹10,000 | 10% |

| 194B | Lottery / gambling winnings | ₹10,000 | 30% |

| 194BA | Online gaming winnings | No limit | 30% |

| 194BB | Horse race winnings | ₹10,000 (aggregate) | 30% |

| 194C | Contractor payments | ₹30,000 / ₹1 lakh | 1% / 2% |

| 194H | Commission / brokerage | ₹20,000 | 2% |

| 194I (a) | Rent – plant & machinery | ₹50,000 | 2% |

| 194I (b) | Rent – land/building | ₹50,000 | 10% |

| 194IA | Property purchase | ₹50 lakh | 1% |

| 194IB | Rent by individual/HUF | ₹50,000 per month | 2% |

| 194J (a) | Technical services | ₹50,000 | 2% |

| 194J (b) | Professional fees | ₹50,000 | 10% |

| 194M | Payments by individual/HUF | ₹50 lakh | 2% |

| 194N | Cash withdrawal | ₹1 crore | 2% |

| 194Q | Purchase of goods | ₹50 lakh | 0.10% |

| 194R | Business perquisites | ₹20,000 | 10% |

| 194S | Virtual digital assets | ₹10,000 / ₹50,000 | 1% |

| 194T | Partner remuneration | ₹20,000 | 10% |

TDS Rates for Non-Residents – FY 2025–26

TDS on non-resident payments is generally higher and depends on the nature of income and DTAA provisions.

Key TDS Rates for Non-Residents

| Section | Income Type | TDS Rate |

|---|---|---|

| 192 | Salary | Slab rates |

| 194E | Sportsmen / sports association | 20% |

| 194LC | Foreign currency bonds | 4% / 9% |

| 194LD | Rupee-denominated bonds | Concessional |

| 195 | Other income | 20% |

| 196A | Units income | 30% |

| 196B | Capital gains on units | 12.5% |

| 196C | Bonds / GDR income | 12.5% |

| 196D | FII income | 20% |

Important:

If a DTAA rate is lower, that rate applies instead of standard TDS.

Revised Threshold Limits from April 2025

One of the most taxpayer-friendly changes in FY 2025–26 is the increase in threshold limits.

Major Threshold Changes

| Section | Old Limit | New Limit |

|---|---|---|

| 193 – Interest on securities | Nil | ₹10,000 |

| 194A – Senior citizen interest | ₹50,000 | ₹1,00,000 |

| 194A – Other interest | ₹40,000 | ₹50,000 |

| 194 – Dividend | ₹5,000 | ₹10,000 |

| 194K – Mutual fund income | ₹5,000 | ₹10,000 |

| 194H – Commission | ₹15,000 | ₹20,000 |

| 194I – Rent | ₹2.4 lakh | ₹6 lakh |

| 194J – Professional fees | ₹30,000 | ₹50,000 |

| 194LA – Compensation | ₹2.5 lakh | ₹5 lakh |

This means fewer transactions attract TDS, improving cash flow for individuals and small businesses.

Impact of TDS Changes on Taxpayers

Salaried Individuals

- No change in slab-based TDS

- Better reconciliation through AIS and Form 26AS

Senior Citizens

- Higher interest exemption limit

- Reduced need for Form 15H in many cases

Freelancers & Professionals

- Higher threshold before TDS applies

- Easier cash flow management

Business Owners

- New Section 194T for partner payments

- Removal of Section 206AB reduces compliance stress

Investors & Traders

- Continued 1% TDS on crypto transactions

- Dividend and MF thresholds doubled

Practical Tips to Avoid Excess TDS

- Submit Form 15G / 15H if eligible

- Ensure PAN is correctly linked

- Check Form 26AS regularly

- Claim DTAA benefits where applicable

- File ITR on time to avoid complications

Conclusion

The TDS rate chart for FY 2025–26 (AY 2026–27) reflects a clear shift toward simplification and taxpayer relief. Higher thresholds, removal of punitive provisions, and targeted new sections make compliance easier without compromising revenue collection.

Understanding these rates is essential to:

- Avoid excess deductions

- Plan cash flows better

- Claim accurate refunds

- Stay compliant with income tax laws

Being informed about TDS today helps you save time, money, and effort tomorrow.

Frequently Asked Questions (FAQs)

1. What is the TDS rate chart for FY 2025–26?

It lists section-wise TDS rates, threshold limits, and applicable percentages for residents and non-residents effective from 1 April 2025.

2. Have TDS rates changed for FY 2025–26?

Most rates remain the same, but threshold limits have increased and Section 194T has been introduced.

3. Is Section 206AB applicable in FY 2025–26?

No. Section 206AB has been removed from 1 April 2025.

4. What is the TDS rate on bank FD interest for senior citizens?

10% TDS applies only if interest exceeds ₹1,00,000 in a financial year.

5. What is the TDS rate on crypto transactions?

1% under Section 194S, subject to threshold limits.

6. What happens if PAN is not provided?

TDS may be deducted at a higher rate as per income tax rules.

7. Can lower DTAA rates apply for NRIs?

Yes. If DTAA rates are lower than standard TDS, the DTAA rate applies.

8. Where can I check my TDS credit?

You can view TDS credits in Form 26AS and the Annual Information Statement (AIS) on the income tax portal.

9. Does higher TDS mean higher tax?

No. TDS is only an advance tax. Final liability is calculated while filing ITR.

10. Is TDS refundable?

Yes. Excess TDS can be claimed as a refund when you file your income tax return.