📄 Stamp Duty & Registration Calculator

Calculate upfront property registration costs across all Indian states

🏠 Property Details

- Rates shown are indicative averages based on standard residential properties

- Metro cities often have additional municipal cess and surcharges

- Under-construction properties may attract different GST rates

- Always verify final charges with local sub-registrar office before payment

- ❌ Stamp duty & registration are NOT included in home loan

- These costs must be paid upfront before taking possession

- Include these in your down payment planning

- Many states offer 1-2% discount for female buyers

Index

- Stamp Duty Calculator – Calculate Property Charges in India

- Stamp Duty & Registration Calculator – Calculate Property Charges in India

- What Is Stamp Duty?

- What Are Registration Charges?

- What Is a Stamp Duty & Registration Calculator?

- How Does the Stamp Duty Calculator Work?

- Why Stamp Duty Calculation Is Important Before Buying a Home

- Stamp Duty Rates in India – Why They Differ by State

- How LoanNestHub’s Stamp Duty Calculator Helps You

- Stamp Duty, EMI & Eligibility – Why All Matter Together

- Frequently Asked Questions (FAQs)

- Final Thoughts

Stamp Duty Calculator – Calculate Property Charges in India

When buying a property in India, the cost does not end with the property price. Buyers must also pay stamp duty and registration charges, which can add a significant amount to the total cost of purchasing a home.

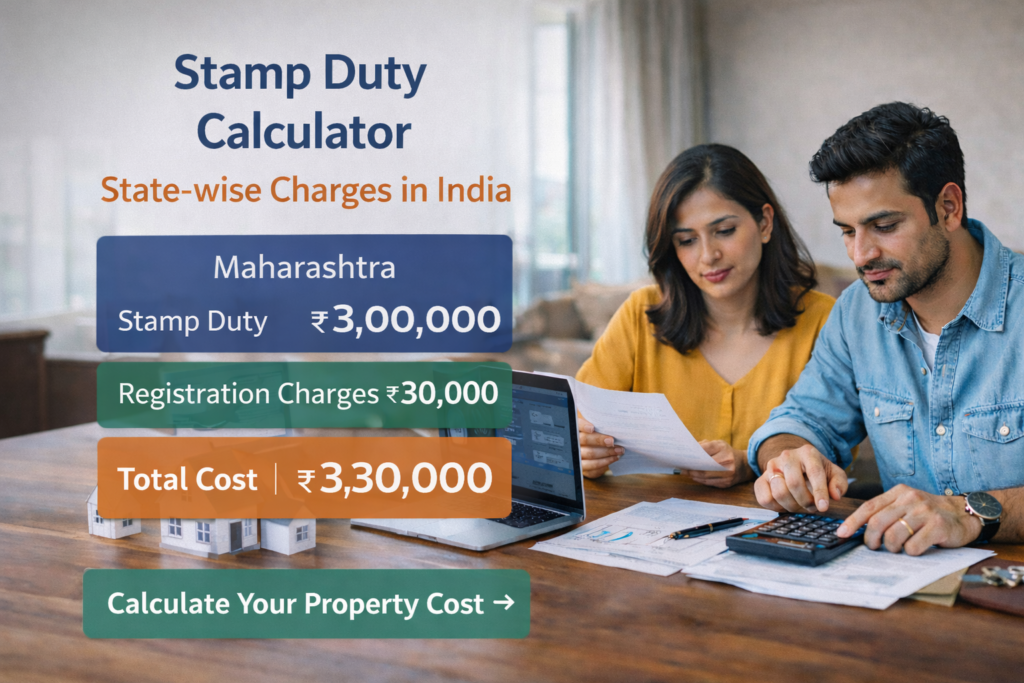

A Stamp Duty & Registration Calculator helps you estimate these charges based on your state, buyer type, and property value, so you can plan your finances better before finalising a property deal.

LoanNestHub’s Stamp Duty Calculator provides state-wise indicative rates to help home buyers understand their upfront costs clearly.

Stamp Duty & Registration Calculator – Calculate Property Charges in India

When buying a property in India, the cost does not end with the property price. Buyers must also pay stamp duty and registration charges, which can add a significant amount to the total cost of purchasing a home.

A Stamp Duty & Registration Calculator helps you estimate these charges based on your state, buyer type, and property value, so you can plan your finances better before finalising a property deal.

LoanNestHub’s Stamp Duty Calculator provides state-wise indicative rates to help home buyers understand their upfront costs clearly.

What Is Stamp Duty?

Stamp duty is a tax levied by state governments on property transactions. It is paid at the time of property registration and is mandatory for legal ownership transfer.

Stamp duty rates differ based on:

- State or Union Territory

- Buyer type (male, female, joint)

- Property value

What Are Registration Charges?

Registration charges are paid to register the property in the buyer’s name with the local sub-registrar office. These charges are usually a fixed percentage of the property value or a capped amount, depending on the state.

What Is a Stamp Duty & Registration Calculator?

A Stamp Duty & Registration Calculator helps you calculate:

- Stamp duty payable

- Registration charges

- Total upfront cost of buying a property

By entering your property value, state, and buyer type, you get an instant estimate of how much extra you need to pay apart from the property price.

How Does the Stamp Duty Calculator Work?

The calculator uses state-wise indicative stamp duty rates and registration charges to estimate the total cost.

It considers:

- Selected state or UT

- Buyer category (male, female, joint)

- Property value

Based on these inputs, it calculates the stamp duty amount, registration charges, and the total upfront payment required.

Why Stamp Duty Calculation Is Important Before Buying a Home

Many home buyers focus only on the property price and home loan amount. However, stamp duty and registration charges:

- Must be paid upfront

- Are generally not covered by home loans

- Can significantly impact your budget

Knowing these charges in advance helps avoid last-minute financial stress.

Stamp Duty Rates in India – Why They Differ by State

Stamp duty is a state subject, which means each state and UT in India sets its own rates. Some states also offer concessions for women buyers or joint ownership.

This is why stamp duty payable in Maharashtra may differ from Karnataka, Delhi, or Uttar Pradesh for the same property value.

How LoanNestHub’s Stamp Duty Calculator Helps You

LoanNestHub’s calculator is designed to provide:

- State-wise stamp duty estimates

- Clear breakup of charges

- Quick calculation without complexity

- Better financial planning before buying

It is especially useful for first-time home buyers who want clarity on total upfront costs.

Stamp Duty, EMI & Eligibility – Why All Matter Together

Stamp duty and registration charges affect your down payment planning, while EMI and eligibility affect your loan affordability.

To make a smart home buying decision, it is important to:

- Calculate stamp duty and registration charges

- Check home loan eligibility

- Calculate monthly EMI

Using these tools together gives a complete picture of your home buying readiness.

Frequently Asked Questions (FAQs)

What is stamp duty in property purchase?

Stamp duty is a state government tax paid for legally registering a property in the buyer’s name.

Are stamp duty and registration charges same across India?

No. Rates vary by state and Union Territory.

Is stamp duty included in home loan?

In most cases, stamp duty and registration charges are not included in the home loan amount.

Can stamp duty rates change?

Yes. State governments may revise stamp duty rates from time to time.

Is this calculator accurate?

The calculator provides indicative estimates based on common state-wise rates. Actual charges may vary by city or local authority.

Final Thoughts

Stamp duty and registration charges are unavoidable costs when buying property in India. Estimating these charges early helps you plan your finances and avoid unpleasant surprises.

Use LoanNestHub’s Stamp Duty & Registration Calculator to calculate state-wise property charges and plan your home purchase with confidence.