Buying a home is one of the biggest financial decisions for most Indian families. While borrowers usually focus on the interest rate, many overlook the processing fee and related charges that come with a home loan. These costs may look small compared to the loan amount, but they directly affect your total upfront expense.

In this article, we explain SBI Home Loan Processing Fee in 2026 in a simple and transparent way—covering charges, GST, possible hidden costs, and how borrowers can plan better.

Index

- What Is a Home Loan Processing Fee?

- SBI Home Loan Processing Fee in 2026

- GST on SBI Home Loan Processing Fee

- Is the Processing Fee Refundable?

- Hidden or Additional Charges You Should Know

- Does SBI Offer Zero Processing Fee Home Loans?

- Impact of Processing Fee on Borrowers

- SBI vs Other Banks: Processing Fee Comparison

- Pros, Cons & Limitations of SBI Processing Fee

- Practical Tips to Reduce Processing Costs

- Conclusion: Is SBI Home Loan Processing Fee Worth It in 2026?

- FAQs: SBI Home Loan Processing Fee 2026

What Is a Home Loan Processing Fee?

A processing fee is a one-time charge levied by the bank for handling your home loan application. This fee covers:

- Verification of documents

- Credit appraisal

- Legal and technical checks of the property

- Administrative and operational costs

For State Bank of India (SBI), the processing fee is generally lower than many private banks, which is one reason SBI home loans remain popular among salaried and self-employed borrowers.

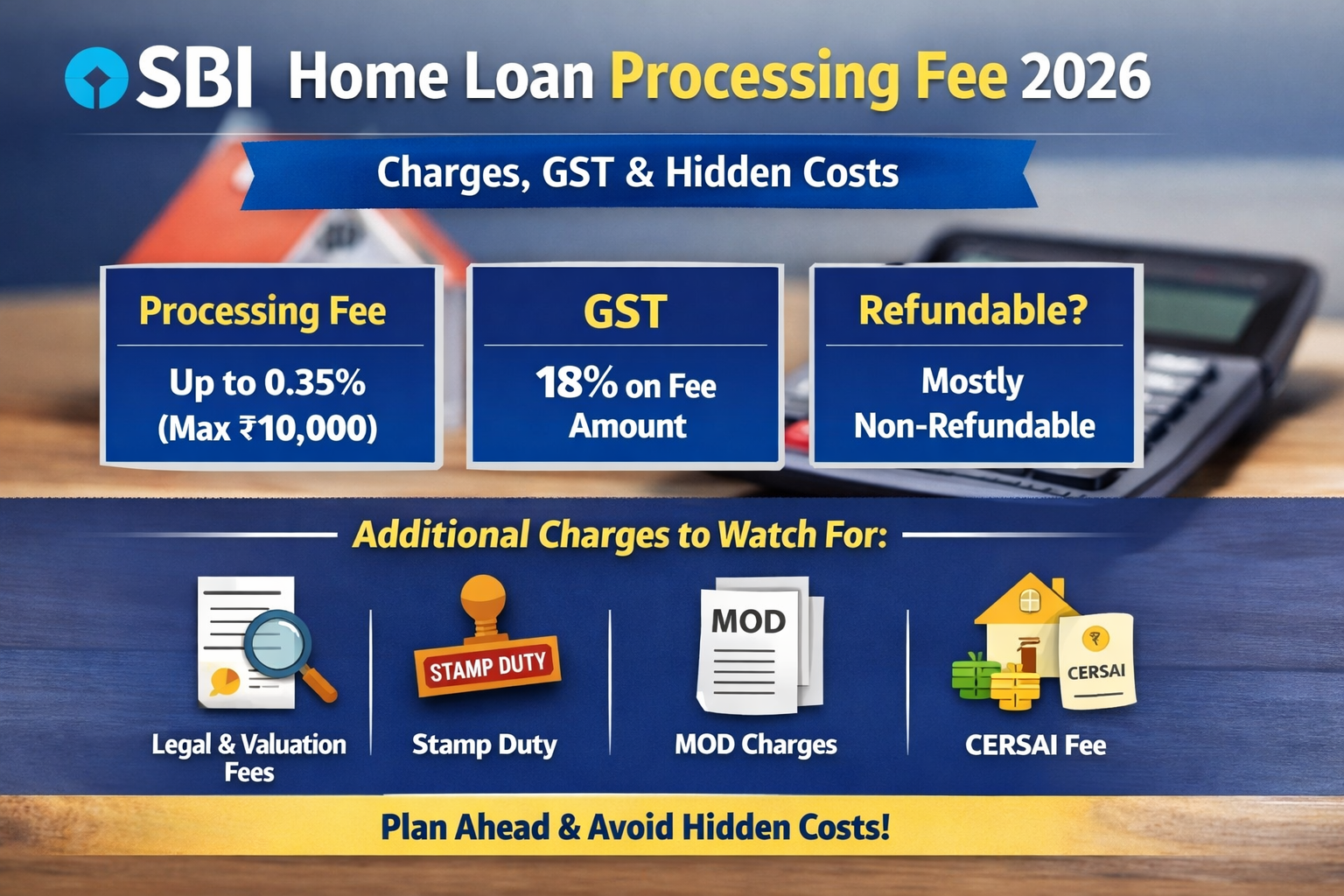

SBI Home Loan Processing Fee in 2026

As per the current structure followed by SBI and expected to continue in 2026:

🔹 Standard Processing Fee

| Loan Type | Processing Fee |

|---|---|

| Regular SBI Home Loan | Up to 0.35% of loan amount |

| Maximum Cap | ₹10,000 (excluding GST) |

👉 This means even if your loan amount is very high, the processing fee is capped.

GST on SBI Home Loan Processing Fee

Processing fees attract Goods and Services Tax (GST).

- GST Rate: 18%

- GST is calculated only on the processing fee, not on the loan amount

Example:

- Processing Fee: ₹10,000

- GST @18%: ₹1,800

- Total Payable: ₹11,800

This GST amount is non-refundable, even if the loan is later cancelled or rejected.

Is the Processing Fee Refundable?

In most cases, SBI home loan processing fee is non-refundable once the application reaches the processing stage.

You may lose the fee if:

- You withdraw the application midway

- The loan is rejected due to eligibility issues

- Property documents fail legal or technical checks

That is why it is important to check eligibility and property readiness before applying.

Hidden or Additional Charges You Should Know

Although SBI is known for transparency, borrowers should still be aware of other charges that may apply.

1️⃣ Legal & Technical Valuation Charges

- Charged for property document verification and site inspection

- May vary by city and property type

- Often charged separately from the processing fee

2️⃣ Stamp Duty on Loan Agreement

- Applicable as per state stamp laws

- Paid at the time of loan agreement execution

3️⃣ MOD / Memorandum of Deposit Charges

- Applicable in certain states (like Maharashtra)

- Charged for registering the mortgage

4️⃣ CERSAI Registration Fee

- Small statutory charge for loan registration

- Usually a few hundred rupees

5️⃣ EMI Bounce Charges

- Applicable if EMI fails due to insufficient balance

- Can include penalty plus GST

These charges are not “hidden” legally, but many borrowers discover them only at the final stage.

Does SBI Offer Zero Processing Fee Home Loans?

Yes, SBI often launches festive or special offers where the processing fee is fully waived.

Such offers are usually:

- Time-bound

- Applicable during festivals or special campaigns

- Subject to loan type and borrower profile

However:

- GST waiver may or may not apply

- Legal and technical charges usually remain payable

Always confirm the written offer details before assuming zero cost.

Impact of Processing Fee on Borrowers

🔹 Short-Term Impact

- Increases upfront cash requirement

- Paid before or at loan sanction stage

🔹 Long-Term Impact

- Does not affect EMI directly

- But adds to the overall cost of borrowing

Even a ₹10,000–₹12,000 fee can matter if you are already stretching your budget for:

- Down payment

- Registration

- Interiors and moving expenses

SBI vs Other Banks: Processing Fee Comparison

| Bank Type | Typical Processing Fee |

|---|---|

| SBI | Up to 0.35% (Capped) |

| PSU Banks | 0.25% – 0.50% |

| Private Banks | 0.50% – 1.00% |

| NBFCs | 1% – 2% or more |

SBI’s lower and capped fee makes it cost-efficient for large loan amounts.

Pros, Cons & Limitations of SBI Processing Fee

✅ Pros

- Lower than private banks

- Maximum cap limits high-cost risk

- Occasional zero-fee offers

- Transparent disclosure

❌ Cons

- GST always applicable

- Non-refundable in most cases

- Additional legal/technical charges apply

⚠️ Limitations

- Waivers depend on campaigns

- Charges may vary slightly by circle/state

Practical Tips to Reduce Processing Costs

- Check eligibility before applying

- Keep documents complete and updated

- Confirm if any festive waiver is active

- Ask for a written fee breakup

- Compare total cost, not just interest rate

Conclusion: Is SBI Home Loan Processing Fee Worth It in 2026?

SBI’s home loan processing fee in 2026 remains one of the most borrower-friendly in the Indian market. With a low percentage, clear cap, and frequent waivers, SBI continues to be a cost-effective choice for long-term home loan borrowers.

However, borrowers should look beyond just the processing fee and understand GST, legal charges, and state-specific costs to avoid surprises. Proper planning ensures your home-buying journey remains smooth and financially balanced.

FAQs: SBI Home Loan Processing Fee 2026

What is the SBI home loan processing fee in 2026?

SBI charges up to 0.35% of the loan amount, capped at ₹10,000, plus GST.

Is GST charged on SBI processing fee?

Yes, 18% GST is applicable on the processing fee amount.

Can SBI waive the processing fee?

Yes, during special festive or promotional offers, SBI may waive the processing fee.

Is the processing fee refundable if the loan is rejected?

Generally, no. The fee is non-refundable once processing starts.

Are legal and technical charges included in the processing fee?

Usually no. These are charged separately based on property and location.

Does SBI charge prepayment or foreclosure fees?

For floating-rate home loans to individuals, SBI does not charge prepayment penalties.

When do I have to pay the processing fee?

It is usually paid at application or before loan sanction.

Is SBI cheaper than private banks in processing fees?

Yes, SBI is typically more affordable, especially for higher loan amounts due to its fee cap.