💰 Home Loan Prepayment Calculator

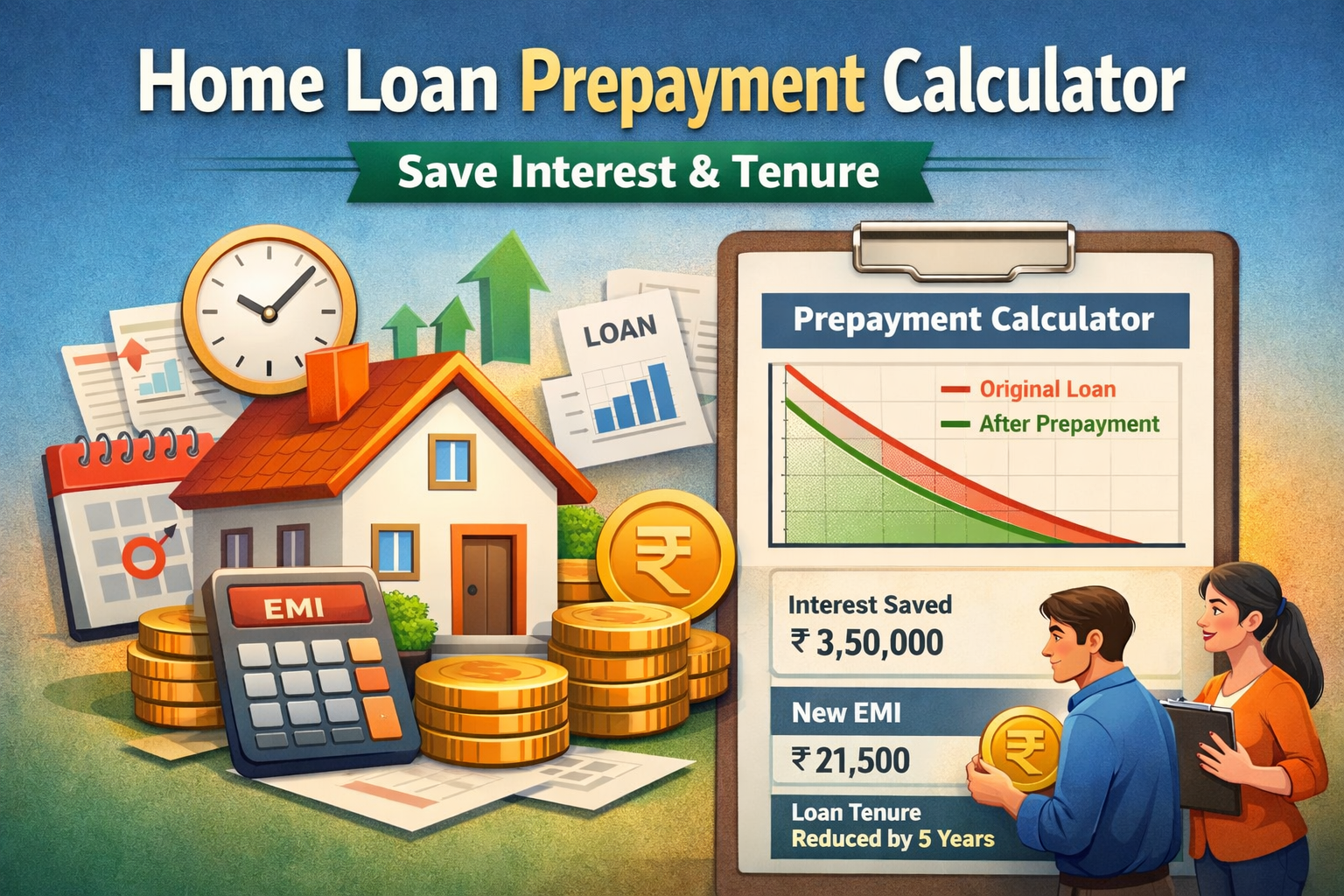

Calculate how much you can save by making prepayments on your home loan

🏦 Current Loan Details

💵 Prepayment Details

📊 Prepayment Strategy

Interest Comparison

A home loan is usually the longest financial commitment in a person’s life. While most borrowers focus only on monthly EMI, the real cost of a home loan lies in the total interest paid over the years. Even a small prepayment, if done at the right time, can help you save lakhs in interest and close your loan much earlier.

The Home Loan Prepayment Calculator helps you understand exactly how prepaying your loan impacts your interest outgo, EMI amount, and remaining loan tenure. Instead of guessing or relying on rough estimates, this tool shows you the real financial difference between continuing your loan as it is versus making a smart prepayment.

This calculator is designed for Indian home loan borrowers who want to take data-driven repayment decisions instead of emotional ones.

Index

- What Is Home Loan Prepayment?

- Why Home Loan Prepayment Matters

- How the Home Loan Prepayment Calculator Works

- EMI Reduction vs Tenure Reduction – Which Is Better?

- When Is the Best Time to Prepay a Home Loan?

- Prepayment Charges and Bank Rules in India

- Who Should Use This Home Loan Prepayment Calculator?

- Frequently Asked Questions (FAQs)

- Final Thoughts

What Is Home Loan Prepayment?

Home loan prepayment means paying an additional amount over and above your regular EMI. This extra payment is adjusted against the outstanding principal, which directly reduces the interest charged in future EMIs.

Prepayment can be done in two ways:

- Lump-sum prepayment – a one-time large payment (bonus, savings, sale proceeds, etc.)

- Partial or periodic prepayment – smaller amounts paid occasionally during the loan tenure

Both methods reduce the total interest burden, but the actual benefit depends on when and how much you prepay.

Why Home Loan Prepayment Matters

In the early years of a home loan, a major portion of your EMI goes toward interest, not principal. This is why prepayment during the initial phase of the loan has a much higher impact compared to later years.

Key benefits of prepayment include:

- Lower total interest payable over the loan tenure

- Faster loan closure and reduced financial stress

- Improved long-term savings and cash flow

- Better flexibility for future investments or goals

However, prepayment is not always an automatic decision. That’s where a reliable calculator becomes essential.

How the Home Loan Prepayment Calculator Works

The Home Loan Prepayment Calculator uses standard EMI and amortization formulas to show the exact impact of prepayment.

You simply need to enter:

- Outstanding loan amount

- Interest rate

- Remaining loan tenure

- Prepayment amount

- Timing of prepayment

- Preferred strategy (reduce EMI or reduce tenure)

Based on these inputs, the calculator instantly shows:

- Total interest savings

- Revised EMI or revised loan tenure

- Difference between original loan and prepayment scenario

- Key insights to help you choose the better strategy

LoanNestHub has built this calculator to keep the logic transparent and practical, making it useful for real-world loan planning.

EMI Reduction vs Tenure Reduction – Which Is Better?

One of the biggest questions borrowers face is whether they should reduce EMI or reduce loan tenure after prepayment.

Reduce Loan Tenure (Keep EMI Same)

- Results in maximum interest savings

- Loan closes earlier

- Best for borrowers with stable income and long-term financial security

Reduce EMI (Keep Tenure Same)

- Improves monthly cash flow

- Makes EMIs more comfortable

- Suitable if you expect income fluctuations or prefer liquidity

This calculator allows you to compare both options side by side, so you can choose what aligns with your financial priorities.

When Is the Best Time to Prepay a Home Loan?

Prepayment is most effective during:

- The first one-third of the loan tenure

- Periods when interest rates are high

- Times when you receive surplus funds (bonus, incentives, inheritance)

Early prepayment delivers the highest interest savings because it reduces the principal before most of the interest is charged.

Prepayment Charges and Bank Rules in India

In India:

- Floating-rate home loans usually have no prepayment penalty

- Fixed-rate loans may attract prepayment charges, depending on the lender

- Some banks may have limits on the number or amount of prepayments per year

Always check your loan agreement before making large prepayments.

Who Should Use This Home Loan Prepayment Calculator?

This tool is ideal for:

- First-time home buyers planning early loan closure

- Existing borrowers evaluating lump-sum prepayment

- Salaried professionals receiving annual bonuses

- Homeowners comparing EMI vs tenure reduction strategies

Whether you are planning a small partial prepayment or a large lump sum, this calculator helps you make a clear and confident decision.

Important Disclaimer

This calculator provides estimates based on standard financial formulas. Actual loan figures may vary slightly depending on your bank’s amortization method, interest reset dates, rounding rules, or applicable charges. Always confirm final numbers with your lender before making a financial decision.

Frequently Asked Questions (FAQs)

What is a home loan prepayment?

Interest savings depend on the prepayment amount, timing, and loan tenure. Early prepayments generally result in the highest savings.

Is prepayment always a good idea?

Prepayment is beneficial if you have surplus funds and no higher-return investment options. However, you should maintain adequate emergency savings before prepaying.

Can I make multiple prepayments?

Yes. Most banks allow multiple partial prepayments, especially for floating-rate loans. Rules may vary by lender.

Does prepayment affect tax benefits?

Prepayment may reduce future interest payments, which can slightly reduce tax deductions under Section 24. However, the overall financial benefit usually outweighs the tax impact.

Is this Home Loan Prepayment Calculator free?

Yes. This calculator is completely free to use and does not require any login or personal data.

Final Thoughts

A home loan should support your financial stability, not restrict it for decades. Smart prepayment decisions can help you save significant interest, reduce stress, and achieve debt-free home ownership faster.

Use the Home Loan Prepayment Calculator regularly to test different scenarios and choose the repayment strategy that truly works for you.