Buying a home is one of the biggest financial decisions for most Indians. A home loan makes this goal achievable, but the approval process depends heavily on one factor – proper documentation.

Many home loan applications are delayed or even rejected not because of low income or poor credit, but due to missing, incorrect, or unclear documents. Knowing exactly which documents are required and why can save you weeks of follow-ups and stress.

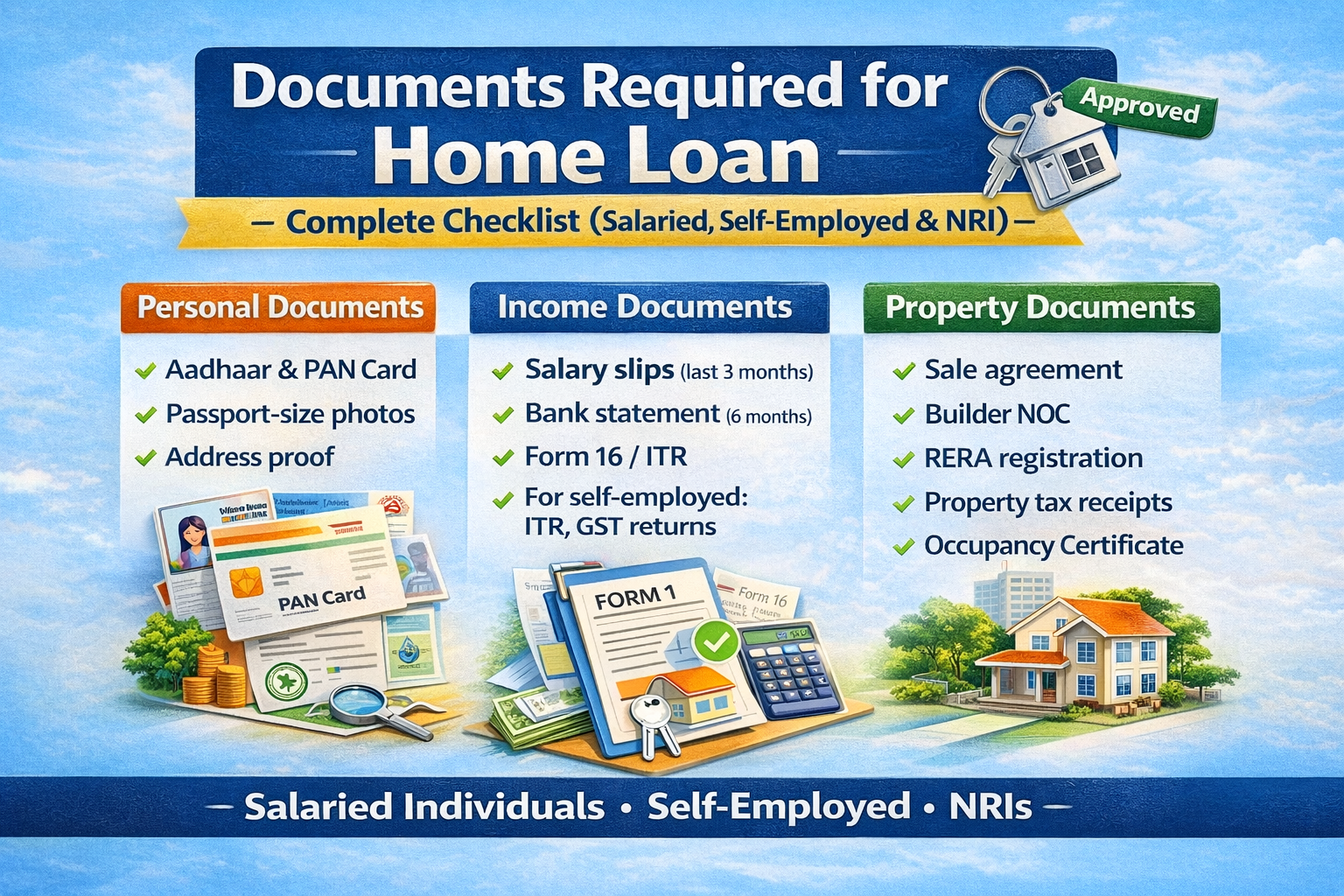

This article explains, in simple terms, all documents required for availing a home loan in India, covering salaried, self-employed, NRI applicants, property-related papers, and balance transfer cases.

Index

- Why Do Banks Ask for So Many Home Loan Documents?

- Common Documents Required for All Home Loan Applicants

- Home Loan Documents for Salaried Individuals

- Home Loan Documents for Self-Employed Individuals & Professionals

- Additional Documents for Partnership Firms / Companies

- Property Documents Required for Home Loan

- Additional Documents for Home Loan Balance Transfer

- Home Loan Documents for NRI / PIO / OCI Applicants

- Common Documentation Mistakes That Delay Home Loan Approval

- How to Apply for a Home Loan Online

- Expert Conclusion: How to Prepare Documents Smartly

- FAQs on Home Loan Documents (India)

Why Do Banks Ask for So Many Home Loan Documents?

Banks and Housing Finance Companies (HFCs) assess three key risks before approving a home loan:

- Identity risk – Who are you?

- Income & repayment risk – Can you repay the loan?

- Property risk – Is the property legally and technically safe?

Documentation helps lenders comply with guidelines issued by the Reserve Bank of India and reduce the chances of fraud, default, or legal disputes.

Common Documents Required for All Home Loan Applicants

These documents are mandatory for every applicant, irrespective of employment type.

1. Home Loan Application Form

- Duly filled application form

- Recent passport-size photographs of all applicants and co-applicants

2. Identity Proof

- Aadhaar Card

- PAN Card

- Passport

- Driving Licence

- Voter ID Card

PAN is compulsory for all home loan applicants.

3. Address Proof

- Aadhaar Card

- Passport

- Driving Licence

- Voter ID

- Utility bills (electricity, gas, telephone – usually last 2-3 months)

- Registered rent agreement

- Ration Card

Home Loan Documents for Salaried Individuals

If you are a salaried employee, banks mainly evaluate job stability and monthly income consistency.

Income & Employment Documents

- Salary slips for the last 3 months

- (Guarantors may be asked for last 1 month)

- Form 16 for the last 1 year

- Income Tax Return (ITR) for last 1 year (if applicable)

- Bank statement for last 6 months (salary account)

- Employee ID card

- Appointment letter / Confirmation letter / Promotion letter

- Used to verify employment duration and continuity

Home Loan Documents for Self-Employed Individuals & Professionals

Self-employed applicants are assessed for business stability, profitability, and cash flow consistency.

Income & Business Proof

- ITR for the last 2 years

- Form 26AS

- Balance Sheet, Profit & Loss statement, and income computation for last 2 years

- Business proof documents, such as:

- Shop Act (Gumasta) Licence

- Registration Certificate

- Service Tax / GST Registration (if applicable)

- IT assessment / clearance certificate

- TDS certificates (if applicable)

- Bank account statement for business operations

Additional Documents for Partnership Firms / Companies

If income is derived through a partnership firm or private limited company, lenders may ask for:

- PAN card and address proof of the firm/company

- Current account statement for the last 12 months

- Memorandum of Association (MOA) & Articles of Association (AOA)

- ITR and audited financials of the firm/company for last 2 years

Property Documents Required for Home Loan

Property documents are critical because the property itself acts as collateral for the loan.

Mandatory Property Papers

- Sale Agreement / Agreement to Sell

- Title deeds and link documents (proof of ownership history)

- Encumbrance Certificate (EC)

- Approved building plan

For Under-Construction Property

- Commencement Certificate

- Builder–buyer agreement

For Ready / Old Property

- Completion Certificate

- Occupancy Certificate (OC)

- Latest property tax paid receipt

- Chain of previous sale agreements (for resale properties)

Other Property Documents

- Allotment letter from housing society

- Lease deed (for leasehold properties)

Additional Documents for Home Loan Balance Transfer

If you are transferring an existing home loan to another lender:

- Loan account statement for the last 12 months

- Original sanction letter

- Foreclosure / No-Objection Certificate (NOC)

- List of original property documents held by the current bank

Home Loan Documents for NRI / PIO / OCI Applicants

NRIs have additional documentation due to overseas income and residency.

Personal & Identity Documents

- Duly filled application form with photographs

- Copy of passport and valid visa

- Address proof (India & overseas)

Financial Documents

- NRE/NRO bank account statement (last 6 months)

- Overseas bank account statement (last 6 months)

- Overseas credit report (if available)

Additional Requirements

- Details of local contact person in India

- Name, address, relationship, and contact number

Common Documentation Mistakes That Delay Home Loan Approval

Many delays are avoidable. Common errors include:

- Incomplete or incorrect application details

- Unclear or blurred document uploads

- Mismatch between income documents and bank statements

- Missing property approvals or certificates

- Incorrect employment or business details

- Forged salary slips or false income declarations

Even small inconsistencies can trigger additional verification or rejection.

How to Apply for a Home Loan Online

Most banks and loan platforms follow a simple online process:

- Enter your mobile number

- Verify via OTP

- Fill loan requirement details

- Provide personal and employment information

- Compare offers and proceed with application

While the process is digital, document verification remains a critical offline and online step.

Expert Conclusion: How to Prepare Documents Smartly

Before applying for a home loan:

- Keep scanned copies of all documents ready

- Ensure consistency across PAN, Aadhaar, bank statements, and income proofs

- Verify property approvals before paying any token amount

- Ask the lender for a document checklist specific to your profile

Well-prepared documentation not only speeds up approval but also improves your chances of getting better interest rates and higher loan eligibility.

FAQs on Home Loan Documents (India)

1. What are the common documents required to avail a home loan?

Identity proof, address proof, income documents, bank statements, photographs, and property documents.

2. Are documents different for salaried and self-employed applicants?

Yes. Salaried applicants submit salary slips and Form 16, while self-employed applicants submit ITRs, balance sheets, and business proof.

3. Is PAN mandatory for home loan application?

Yes. PAN is compulsory for all home loan applicants in India.

4. What documents are required for home loan balance transfer?

Existing loan statement, sanction letter, foreclosure letter, and list of documents held by the current bank.

5. Can a home loan be approved without property documents?

No. Property documents are mandatory as the property is the loan collateral.

6. Do pre-approved home loan customers need documents?

In most cases, pre-approved customers need minimal documentation, but property documents are still required.

7. How many months of bank statements are required?

Typically, banks ask for last 6 months bank statements.

8. Are NRI home loan documents different?

Yes. NRIs must submit passport, visa, overseas income proofs, and foreign bank statements.

1 thought on “Documents Required for Availing a Home Loan in India 2026”