Amortization Table

| Year | Opening Balance | Interest Paid | Principal Repaid | Closing Balance |

|---|

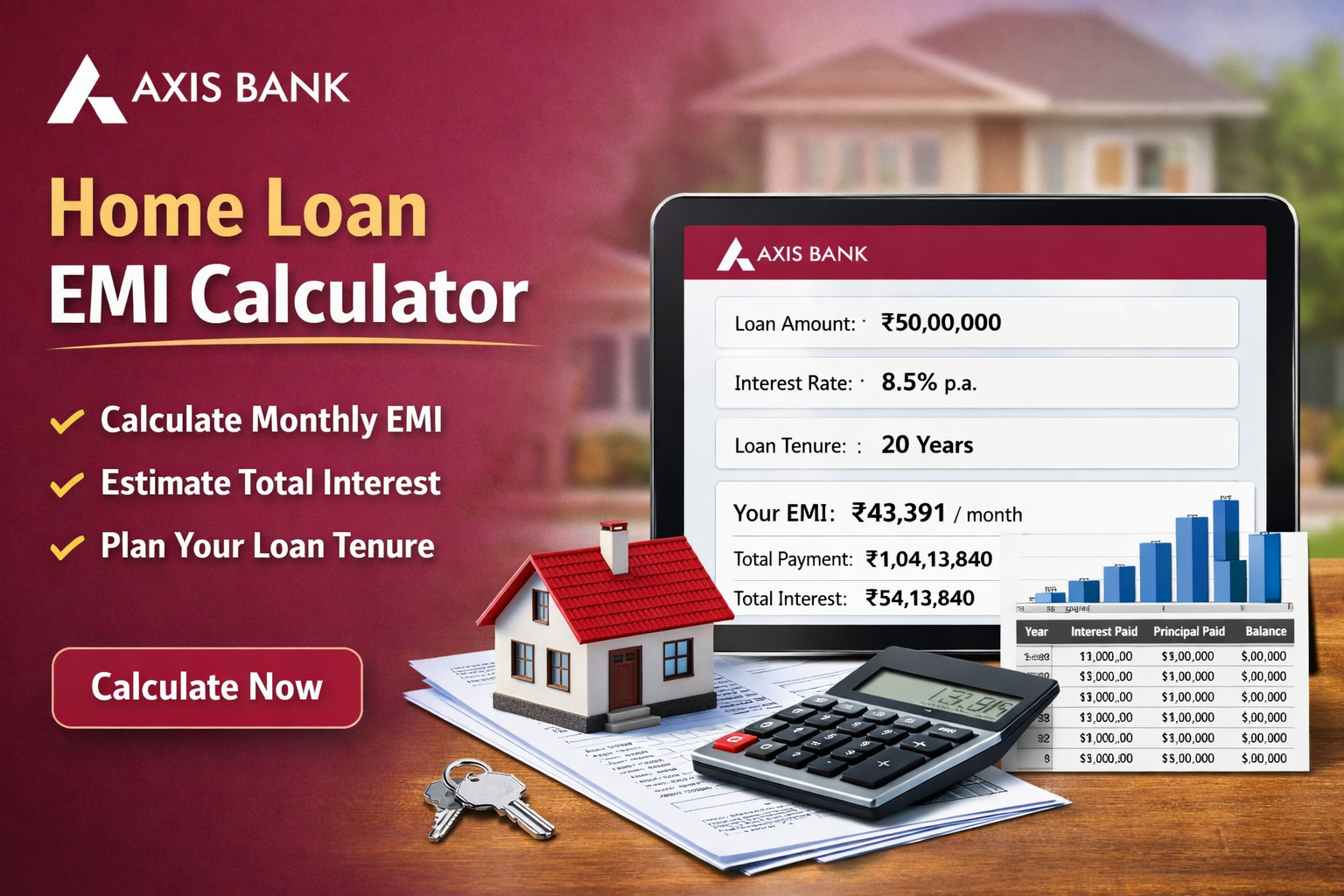

Buying a home is one of the biggest financial decisions most Indians make. Before choosing a property or finalising a loan amount, it is important to clearly understand how much EMI you will pay every month and how long that commitment will last.

The Axis Bank Home Loan EMI Calculator helps you estimate your monthly instalment in advance so that you can plan your finances with confidence and avoid over-stretching your budget.

This guide explains what the EMI calculator is, how it works, why it matters, and how you can use it effectively while planning a home loan from Axis Bank.

Index

- What Is a Home Loan EMI Calculator?

- Why the Axis Bank Home Loan EMI Calculator Matters Today

- Key Components Used in EMI Calculation

- How the Axis Bank Home Loan EMI Calculator Works

- Step-by-Step: How to Use Axis Bank Home Loan EMI Calculator

- Understanding the Amortisation Schedule

- Practical EMI Examples (Simple Illustration)

- How EMI Impacts Your Monthly Budget

- Comparing Different Loan Scenarios Using the Calculator

- Benefits of Using Axis Bank Home Loan EMI Calculator

- Limitations of EMI Calculators You Should Know

- Who Should Use the Axis Bank Home Loan EMI Calculator?

- Conclusion

- Frequently Asked Questions (FAQs)

What Is a Home Loan EMI Calculator?

A Home Loan EMI Calculator is a free online tool that calculates the Equated Monthly Instalment (EMI) you need to pay for a housing loan.

You only need to enter:

- Loan amount

- Interest rate

- Loan tenure

Based on these inputs, the calculator instantly shows:

- Monthly EMI

- Total amount payable

- Total interest outgo

- Year-wise amortisation schedule

The Axis Bank Home Loan EMI Calculator uses standard financial formulas to give a near-accurate estimate of your repayment obligation.

Why the Axis Bank Home Loan EMI Calculator Matters Today

Home loan interest rates, property prices, and living costs have all risen over the years. Even a small change in interest rate or tenure can significantly impact your EMI.

Using an EMI calculator before applying for a loan helps you:

- Decide how much loan you can safely afford

- Choose the right tenure based on income stability

- Compare different loan scenarios without paperwork

- Avoid future repayment stress

For first-time home buyers, this tool removes confusion and sets realistic expectations.

Key Components Used in EMI Calculation

To understand the calculator output better, it helps to know the three core inputs.

1. Loan Amount

This is the total amount you borrow from the bank after paying your down payment.

Example:

- Property value: ₹70 lakh

- Down payment: ₹20 lakh

- Loan amount: ₹50 lakh

2. Interest Rate

This is the annual interest charged by the bank.

Most home loans in India are floating-rate loans, which means rates may change over time based on RBI benchmarks.

3. Loan Tenure

The total repayment period, usually ranging from 1 year to 30 years.

- Longer tenure → Lower EMI, higher total interest

- Shorter tenure → Higher EMI, lower total interest

How the Axis Bank Home Loan EMI Calculator Works

The calculator applies a standard EMI formula based on compound interest.

EMI Formula (Simplified)

EMI depends on:

- Principal (P)

- Monthly interest rate (r)

- Number of monthly instalments (n)

While the formula itself looks complex, the calculator handles everything instantly in the background and displays clear results.

You do not need to manually calculate anything.

Step-by-Step: How to Use Axis Bank Home Loan EMI Calculator

Using the calculator is simple and takes less than a minute.

Step 1: Enter Loan Amount

Input the amount you plan to borrow (for example, ₹30 lakh or ₹50 lakh).

Step 2: Enter Interest Rate

Add the applicable annual interest rate offered by Axis Bank.

Step 3: Select Loan Tenure

Choose the repayment period in years (up to 30 years).

Step 4: View Instant EMI

The calculator immediately displays:

- Monthly EMI

- Total amount payable

- Total interest

Step 5: Check Amortisation Schedule

Review the year-wise breakup of:

- Opening balance

- Interest paid

- Principal repaid

- Closing balance

This helps you understand how your loan reduces over time.

Understanding the Amortisation Schedule

An amortisation schedule shows how each year’s EMI is split between interest and principal.

Important Insight for Borrowers

- In the initial years, a large portion of EMI goes towards interest

- In later years, principal repayment increases

- This is why prepayments early in the loan tenure save more interest

The Axis Bank EMI calculator clearly displays this pattern, helping borrowers plan prepayments strategically.

Practical EMI Examples (Simple Illustration)

| Loan Amount | Interest Rate | Tenure | Approx EMI |

|---|---|---|---|

| ₹20 lakh | 8.5% | 10 years | ~₹24,800 |

| ₹30 lakh | 8.5% | 20 years | ~₹26,000 |

| ₹50 lakh | 8.75% | 20 years | ~₹44,000 |

Figures are indicative and may vary based on final interest rate and loan terms.

How EMI Impacts Your Monthly Budget

Before finalising a home loan, you should check whether the EMI fits comfortably within your income.

Common Financial Thumb Rule

- Home loan EMI should ideally be not more than 30–40% of monthly income

Example:

- Monthly income: ₹1,00,000

- Comfortable EMI range: ₹30,000–₹40,000

The EMI calculator helps you reverse-engineer the loan amount based on this limit.

Comparing Different Loan Scenarios Using the Calculator

One of the biggest advantages of the Axis Bank Home Loan EMI Calculator is scenario testing.

You can compare:

- Short tenure vs long tenure

- Lower loan amount vs higher loan amount

- Current rate vs possible future rate

This helps you understand trade-offs rather than blindly choosing the lowest EMI.

Benefits of Using Axis Bank Home Loan EMI Calculator

Financial Clarity

You know your repayment commitment upfront, reducing surprises later.

Better Budget Planning

Helps align home loan EMI with other financial goals like savings, insurance, and education expenses.

Time-Saving

Instant results without manual calculations or spreadsheets.

Interest Awareness

Shows total interest outflow, encouraging smarter decisions like higher down payment or shorter tenure.

Stress Testing

Allows you to evaluate the impact of interest rate changes on floating-rate loans.

Limitations of EMI Calculators You Should Know

While useful, EMI calculators have some limitations.

- Results are indicative, not final sanction amounts

- Do not include additional costs like:

- Processing fees

- Insurance premium

- Legal or valuation charges

- Floating rate changes over time are not auto-adjusted

Still, the calculator is an excellent planning tool, not a replacement for official loan sanction details.

Who Should Use the Axis Bank Home Loan EMI Calculator?

This calculator is useful for:

- First-time home buyers

- Salaried professionals planning affordability

- Self-employed individuals testing tenure flexibility

- Borrowers comparing different loan amounts

- Existing borrowers planning balance transfer or prepayment

Conclusion

The Axis Bank Home Loan EMI Calculator is a practical, easy-to-use tool that helps borrowers understand repayment obligations before committing to a long-term loan.

It is best used to:

- Set realistic expectations

- Compare loan scenarios

- Avoid EMI stress

- Make informed financial decisions

Used early in your home-buying journey, it can prevent costly mistakes later.

Frequently Asked Questions (FAQs)

1. What is the Axis Bank Home Loan EMI Calculator?

It is a free online tool that estimates your monthly home loan EMI based on loan amount, interest rate, and tenure.

2. Is the EMI shown by the calculator final?

No. The EMI is indicative. Final EMI depends on sanctioned interest rate and loan terms.

3. Can I calculate EMI for a 30-year home loan?

Yes. Axis Bank allows home loan tenures of up to 30 years, and the calculator supports this.

4. Does the calculator include processing fees?

No. It only calculates EMI based on principal and interest, not additional charges.

5. How accurate is the amortisation schedule?

The schedule is mathematically accurate based on inputs but may change if interest rates are revised.

6. Can I use the calculator for balance transfer planning?

Yes. It helps compare EMI under different rates and tenures before transferring a loan.

7. Does prepayment reduce EMI or tenure?

Usually, prepayment reduces loan tenure, but EMI reduction is also possible depending on bank policy.

8. Is the EMI calculator suitable for first-time buyers?

Yes. It is especially helpful for beginners to understand loan affordability.