Home loan borrowers often look only at the interest rate, but the way a loan is structured can make an even bigger difference to the total interest paid over 20–30 years. This is where the SBI Maxgain Home Loan stands apart from regular home loans.

In this guide, we explain SBI Maxgain Home Loan 2026 in a clear and practical manner covering interest rates, benefits, eligibility, and most importantly, how the Maxgain overdraft mechanism actually works. This article is written for first-time learners as well as borrowers comparing advanced home loan options.

Index

- Why SBI Maxgain Matters in 2026

- What Is SBI Maxgain Home Loan?

- How SBI Maxgain Works

- SBI Maxgain Home Loan Interest Rate 2026

- Why Interest Rate Alone Is Not the Right Comparison

- Key Features of SBI Maxgain Home Loan

- SBI Maxgain Eligibility Criteria 2026

- Who Should Choose SBI Maxgain Home Loan?

- SBI Maxgain vs Regular SBI Home Loan

- Cost Impact: How Much Can You Really Save?

- Risks & Practical Limitations of SBI Maxgain

- SBI Maxgain Charges & Fees

- Tools & Practical Aids for Maxgain Borrowers

- Conclusion

- FAQs: SBI Maxgain Home Loan 2026

Why SBI Maxgain Matters in 2026

In 2026, many borrowers are facing:

- Uncertain interest rate cycles

- Irregular cash flows (bonuses, business income, incentives)

- A desire to reduce interest without locking money away

The State Bank of India (SBI) Maxgain Home Loan is designed specifically for such borrowers. Instead of forcing you to prepay your loan and lose liquidity, Maxgain allows you to park surplus funds and save interest daily, while still having access to your money.

This flexibility is the core reason Maxgain continues to attract financially disciplined borrowers.

What Is SBI Maxgain Home Loan?

SBI Maxgain is a home loan with overdraft facility.

In simple terms:

- Your home loan account is linked to a special current/OD account

- Any extra money you deposit reduces the interest calculation

- You can withdraw that money anytime, unlike regular prepayments

You pay interest only on the net outstanding balance, not the full sanctioned loan amount.

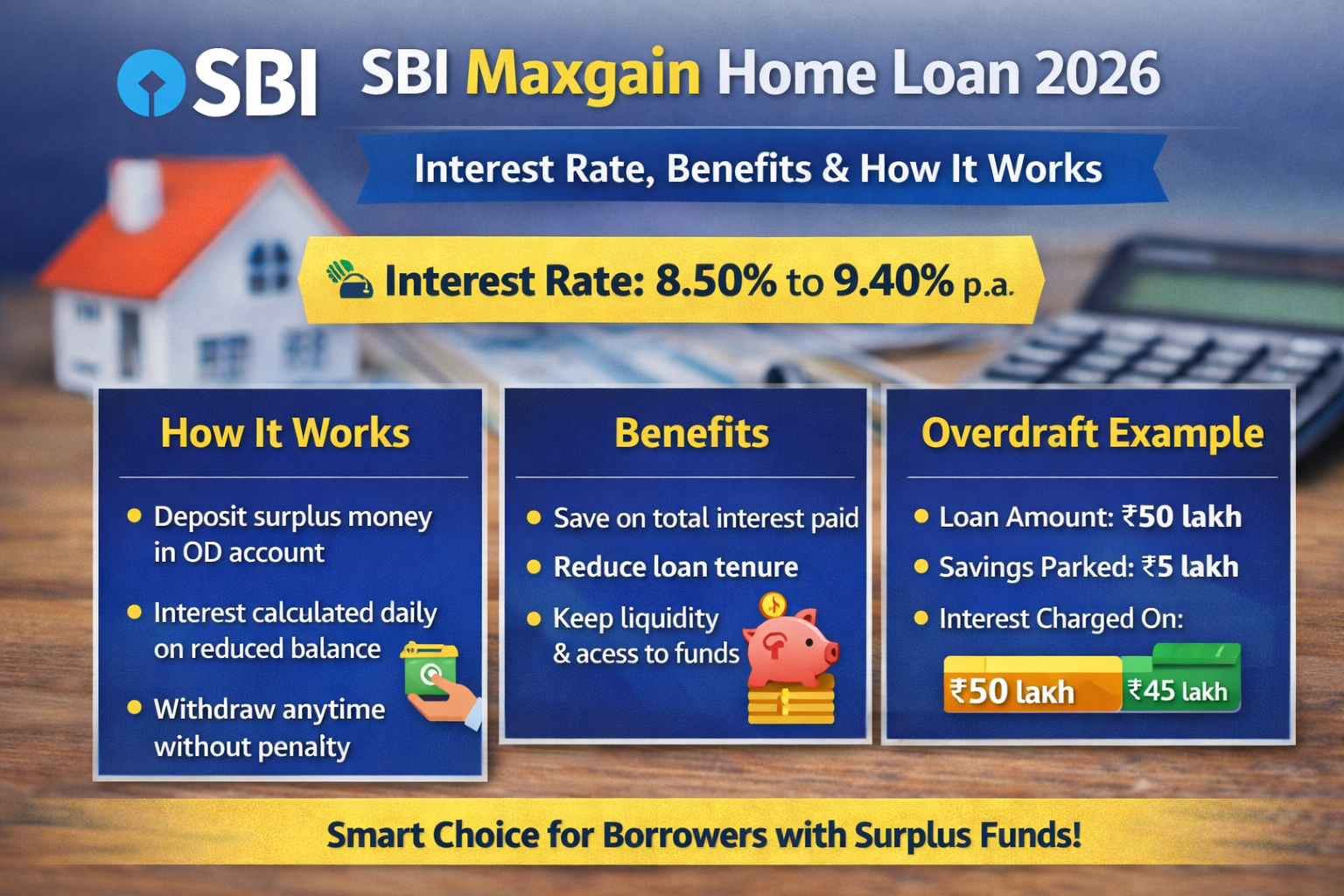

How SBI Maxgain Works

Let’s understand this with a basic example.

Example Scenario

- Home Loan Amount: ₹50 lakh

- Interest Rate: 8.75%

- Extra savings parked: ₹5 lakh

What Happens in Maxgain

- Interest is calculated on ₹45 lakh, not ₹50 lakh

- EMI remains same

- Loan tenure reduces automatically

- You can withdraw the ₹5 lakh anytime

This daily interest reduction is the biggest advantage of Maxgain.

SBI Maxgain Home Loan Interest Rate 2026

🔹 Interest Rate Structure

In 2026, SBI Maxgain interest rates are typically:

👉 0.10% to 0.25% higher than SBI regular home loan rates

This slightly higher rate exists because:

- SBI offers overdraft flexibility

- Operational costs are higher for OD accounts

However, for disciplined borrowers, interest savings usually exceed this difference.

Why Interest Rate Alone Is Not the Right Comparison

Many borrowers reject Maxgain because:

“The interest rate is higher than a regular home loan.”

This is a partial comparison.

What actually matters is:

- Average outstanding balance

- How often you park surplus funds

- How long surplus stays in the account

If you regularly maintain extra funds, Maxgain becomes cheaper overall, despite the higher headline rate.

Key Features of SBI Maxgain Home Loan

🔹 Overdraft Facility

- Deposit surplus funds anytime

- Withdraw funds without penalty

🔹 Interest Calculation

- Calculated daily on net balance

- Lower outstanding = lower interest

🔹 Loan Tenure

- Up to 30 years

- Often closes earlier due to interest savings

🔹 Prepayment Rules

- No prepayment penalty

- OD deposits act like smart prepayment

🔹 Transparency

- Fully repo-linked floating interest rate

SBI Maxgain Eligibility Criteria 2026

1. Eligible Borrowers

- Salaried individuals with stable income

- Self-employed professionals

- Business owners with predictable cash flows

2. Income & Profile Preference

- Strong preference for high-credit-score borrowers

- Regular surplus income is a key advantage

3. Age Criteria

- Minimum: 18 years

- Maximum at maturity:

- Salaried: ~60 years

- Self-employed: ~65 years

Who Should Choose SBI Maxgain Home Loan?

Maxgain is not for everyone.

Best Suited For:

- Borrowers with regular surplus savings

- Professionals receiving bonuses/incentives

- Business owners with fluctuating cash flow

- Investors who want liquidity + interest saving

Not Ideal For:

- Borrowers living paycheck to paycheck

- Those unlikely to maintain surplus balance

- People who may misuse OD withdrawals

SBI Maxgain vs Regular SBI Home Loan

| Feature | SBI Regular Home Loan | SBI Maxgain Home Loan |

|---|---|---|

| Interest Rate | Lower | Slightly higher |

| Overdraft Facility | No | Yes |

| Liquidity | Low | Very High |

| Interest Saving | Limited | High (if surplus used) |

| Discipline Required | Moderate | High |

Maxgain rewards financial discipline, not impulsive spending.

Cost Impact: How Much Can You Really Save?

Even without complex math, the logic is simple:

- Parking ₹3–5 lakh consistently

- Over 10–15 years

- At ~8.5% interest

Can reduce:

- Total interest by several lakhs

- Loan tenure by multiple years

This makes Maxgain powerful for long-term planners.

Risks & Practical Limitations of SBI Maxgain

⚠️ Withdrawal Temptation

Easy access may lead to frequent withdrawals, reducing benefits.

⚠️ Higher Interest If Not Used Properly

If surplus is not maintained, Maxgain can be costlier than a regular loan.

⚠️ Account Discipline Needed

Requires active tracking and financial planning.

SBI Maxgain Charges & Fees

| Charge Type | Details |

|---|---|

| Processing Fee | Similar to regular SBI home loan |

| GST | 18% on applicable charges |

| Prepayment Charges | Nil |

| OD Account Charges | Minimal, bank-specific |

Charges are not excessive, but benefits depend on usage.

Tools & Practical Aids for Maxgain Borrowers

Before choosing Maxgain:

- Use home loan EMI calculators

- Estimate realistic surplus you can maintain

- Compare interest saving over 5–10 years

If surplus is irregular or emotional spending is high, Maxgain may not work optimally.

Conclusion

The SBI Maxgain Home Loan in 2026 is a powerful but discipline-driven product. It is not designed to look cheap on paper; it is designed to reward smart money management.

If you:

- Have surplus funds

- Value liquidity

- Want to actively reduce interest burden

Then Maxgain can outperform a regular home loan by a wide margin. However, without discipline, its advantages disappear.

In short, Maxgain is not for everyone but for the right borrower, it is one of the smartest home loan structures in India.

FAQs: SBI Maxgain Home Loan 2026

What is SBI Maxgain Home Loan?

It is a home loan with overdraft facility where surplus funds reduce interest daily.

Is SBI Maxgain interest rate higher than regular home loan?

Yes, slightly higher but overall interest paid can be lower with surplus usage.

Can I withdraw money deposited in Maxgain?

Yes, you can withdraw surplus funds anytime without penalty.

Does SBI Maxgain reduce EMI?

Usually EMI stays same, but loan tenure reduces faster.

Is SBI Maxgain suitable for salaried employees?

Yes, especially those receiving bonuses or variable pay.

Are there prepayment charges in SBI Maxgain?

No, there are no prepayment or foreclosure penalties.

What happens if I don’t maintain surplus balance?

Then Maxgain may become costlier than a regular home loan.

Is SBI Maxgain better than home loan prepayment?

Yes, because it offers interest saving without losing liquidity.