For most Indian families, a home loan is a long-term financial commitment that can last 20 to 30 years. Even a small difference in interest rate can change the total amount you repay by several lakhs of rupees. That is why understanding the SBI Regular Home Loan interest rate in 2026, along with eligibility and features, is extremely important before you apply.

In this article, we explain SBI’s regular home loan in a clear, practical, and beginner-friendly way so you can decide whether it suits your income, goals, and risk comfort.

Index

- Why SBI Home Loan Interest Rates Matter in 2026

- What Is an SBI Regular Home Loan?

- SBI Regular Home Loan Interest Rate 2026

- How SBI Decides Your Home Loan Interest Rate

- Credit Score–Wise Interest Rate Impact

- SBI Regular Home Loan Eligibility Criteria 2026

- Employment & Profession Eligibility

- Property Eligibility Rules

- Key Features of SBI Regular Home Loan

- SBI Regular Home Loan Charges

- Impact of Interest Rate on Borrowers

- SBI vs Other Banks: Interest Rate Comparison

- Pros, Cons & Limitations of SBI Regular Home Loan

- Tools & Practical Aids for Borrowers

- Conclusion

- FAQs: SBI Regular Home Loan Interest Rate 2026

Why SBI Home Loan Interest Rates Matter in 2026

Home loan interest rates in India are closely linked to RBI policy rates, inflation, and banking liquidity. Over the last few years, borrowers have seen rate changes more frequently due to repo-linked lending.

State Bank of India (SBI) is the largest home loan lender in the country. Because of its size and government ownership, SBI often sets a benchmark for other banks, especially in the public sector.

For borrowers in 2026, the key question is:

- Is SBI’s regular home loan interest rate competitive?

- Who can get the lowest rates?

- What are the long-term implications?

This guide answers all of that.

What Is an SBI Regular Home Loan?

An SBI Regular Home Loan is the standard home loan product offered to most borrowers, including:

- Salaried individuals

- Self-employed professionals

- Business owners

- Joint applicants

It can be used for:

- Buying a ready or under-construction house

- Purchasing a plot (with or without construction)

- Buying a resale property

This is different from SBI’s special schemes for women, government employees, or NRIs.

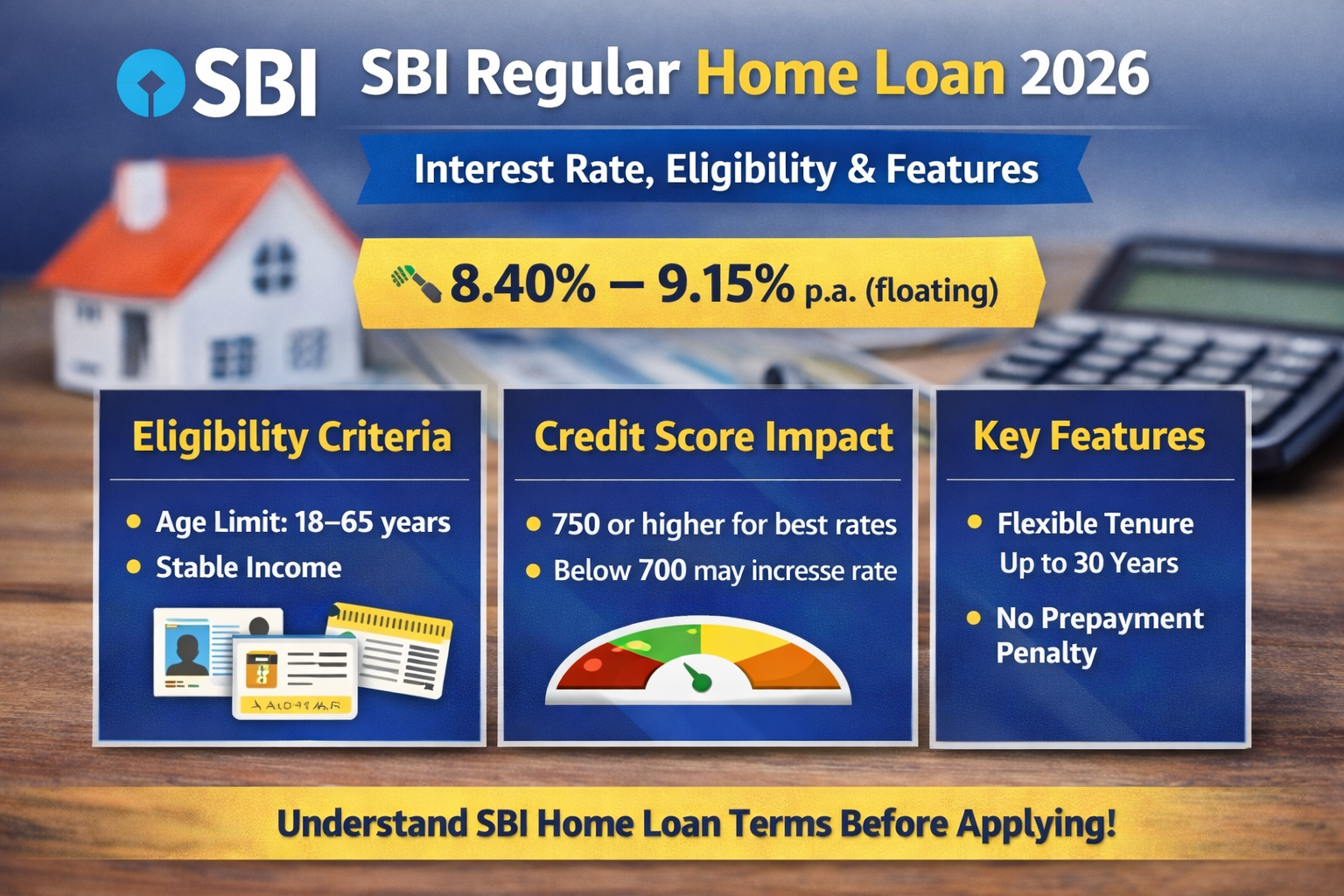

SBI Regular Home Loan Interest Rate 2026

🔹 Interest Rate Range (Indicative)

In 2026, SBI regular home loan interest rates are expected to be in the range of:

👉 8.40% to 9.15% per annum (floating rate)

The exact rate depends on your:

- Credit score

- Income stability

- Loan amount

- Loan-to-value (LTV) ratio

How SBI Decides Your Home Loan Interest Rate

SBI follows a Repo Linked Lending Rate (RLLR) system.

What This Means in Simple Terms

- RBI sets the repo rate

- SBI adds a fixed margin to it

- Your home loan rate moves when repo rate changes

This system is more transparent than older base-rate methods.

Credit Score–Wise Interest Rate Impact

Your CIBIL score plays a major role in deciding the final interest rate.

| Credit Score Range | Expected Interest Rate |

|---|---|

| 800 & above | Lowest slab |

| 750 – 799 | Slightly higher |

| 700 – 749 | Moderate |

| Below 700 | Higher rate or rejection |

Practical Tip:

Improving your credit score by even 20–30 points can reduce your EMI meaningfully over 20+ years.

SBI Regular Home Loan Eligibility Criteria 2026

1️⃣ Age Criteria

- Minimum: 18 years

- Maximum at loan maturity:

- Salaried: ~60 years

- Self-employed: ~65 years

2️⃣ Income Eligibility

- Salaried: Stable monthly income

- Self-employed: Consistent business income with ITR history

There is no fixed minimum salary, but EMI should usually not exceed 50–55% of net monthly income.

Employment & Profession Eligibility

SBI accepts applications from:

- Private company employees

- Government & PSU employees

- Doctors, CAs, architects

- Business owners with stable operations

However, income continuity is more important than job title.

Property Eligibility Rules

The property you buy must:

- Be legally approved

- Have clear title

- Follow local development authority norms

- Be acceptable under SBI’s legal and technical checks

SBI is known for strict property scrutiny, which reduces future legal risks.

Key Features of SBI Regular Home Loan

🔹 Loan Amount

- From a few lakhs to several crores

- Based on income and repayment capacity

🔹 Loan Tenure

- Up to 30 years

- Longer tenure reduces EMI but increases total interest

🔹 Interest Type

- Floating rate only (linked to repo rate)

🔹 Prepayment & Foreclosure

- No prepayment penalty for individuals on floating-rate loans

🔹 Balance Transfer Facility

- Allowed from other banks to SBI

SBI Regular Home Loan Charges

| Charge Type | Details |

|---|---|

| Processing Fee | Up to 0.35% (capped) |

| GST | 18% on applicable charges |

| Prepayment Charges | Nil (floating rate) |

| Legal & Technical Fees | As applicable |

These charges are generally lower than private banks for large loan amounts.

Impact of Interest Rate on Borrowers

Assume:

- Loan Amount: ₹50 lakh

- Tenure: 25 years

Scenario 1: Interest Rate 8.50%

- EMI ≈ Lower

- Total interest ≈ Moderate

Scenario 2: Interest Rate 9.00%

- EMI slightly higher

- Total interest increases by several lakhs

Even a 0.50% difference matters significantly over long tenure.

SBI vs Other Banks: Interest Rate Comparison

| Bank Type | Interest Rate Trend |

|---|---|

| SBI | Stable, transparent |

| PSU Banks | Similar to SBI |

| Private Banks | Lower entry rates, higher later |

| NBFCs | Higher overall |

SBI may not always have the lowest advertised rate, but it is predictable and transparent.

Pros, Cons & Limitations of SBI Regular Home Loan

✅ Pros

- Transparent repo-linked rates

- No foreclosure penalty

- Strong legal verification

- Long tenure up to 30 years

❌ Cons

- Documentation process is detailed

- Approval may take slightly longer

- Less flexibility for low credit scores

⚠️ Limitations

- Floating rate risk remains

- Rate benefits depend heavily on credit score

Tools & Practical Aids for Borrowers

Before applying, borrowers should use:

- EMI calculators to compare tenure options

- Credit score check tools

- Home loan eligibility calculators

These tools help you choose the right loan amount, not just the maximum possible one.

Conclusion

The SBI Regular Home Loan interest rate in 2026 remains a strong option for borrowers who prefer stability, transparency, and long-term safety over aggressive short-term discounts.

SBI home loans are best suited for:

- Salaried individuals with stable income

- Borrowers planning long tenures

- Buyers who value strict legal checks

If your credit score is healthy and documents are in order, SBI’s regular home loan can be a reliable and cost-effective choice over the long run.

FAQs: SBI Regular Home Loan Interest Rate 2026

What is the SBI regular home loan interest rate in 2026?

It generally ranges from 8.40% to 9.15%, depending on credit score and profile.

Is SBI home loan interest rate fixed or floating?

SBI offers floating-rate home loans linked to the repo rate.

How can I get the lowest SBI home loan interest rate?

Maintain a high credit score, stable income, and lower loan-to-value ratio.

Does SBI charge prepayment penalty?

No, SBI does not charge prepayment or foreclosure fees for floating-rate loans to individuals.

Can SBI change my interest rate during the loan tenure?

Yes, rates change when the RBI repo rate changes.

Is SBI better than private banks for home loans?

SBI offers more transparency and stability, while private banks may offer faster processing.

What tenure is best for SBI home loan?

A balance between affordable EMI and reasonable total interest often 20–25 years.

Can self-employed borrowers get SBI regular home loan?

Yes, provided they show stable income and proper ITR history.