Home loan interest rates are not the same for every borrower. In 2026, one of the most important factors that decides the interest rate on an SBI home loan is your CIBIL score. Even when two people apply for the same loan amount and tenure, their interest rates can differ based on credit history.

As India’s largest home loan lender, State Bank of India (SBI) follows a risk-based pricing system. This means borrowers with stronger credit profiles are rewarded with lower interest rates, while higher-risk borrowers pay slightly more.

This article explains how SBI home loan interest rates vary based on CIBIL score in 2026, why this system exists, and how it impacts your EMI and long-term loan cost.

Index

- Why CIBIL Score Matters for SBI Home Loans in 2026

- How SBI Decides Home Loan Interest Rates

- SBI Home Loan Interest Rates Based on CIBIL Score 2026

- What Is Considered a Good CIBIL Score for SBI Home Loan?

- How Much Difference Does CIBIL Score Make in EMI?

- SBI Home Loan for Borrowers with No CIBIL Score

- Can SBI Reject a Home Loan Due to Low CIBIL Score?

- How to Improve Your CIBIL Score Before Applying for SBI Home Loan

- Limitations of CIBIL-Based Pricing

- Using EMI Calculators to Understand Impact

- Expert Conclusion

- Frequently Asked Questions (FAQs)

Why CIBIL Score Matters for SBI Home Loans in 2026

A CIBIL score is a three-digit number that represents your credit behaviour. It is calculated using your past loan repayments, credit card usage, defaults (if any), and overall credit discipline.

In 2026, SBI uses the CIBIL score to:

- Assess repayment risk

- Decide interest rate slabs

- Determine loan eligibility limits

- Evaluate approval or rejection risk

Since most SBI home loans are repo-linked floating-rate loans, the base rate is common, but the final rate differs based on borrower risk — and CIBIL score is the biggest risk indicator.

How SBI Decides Home Loan Interest Rates

SBI home loan interest rates are linked to the External Benchmark Lending Rate (EBLR). This benchmark is derived from the RBI repo rate.

Basic structure:

RBI Repo Rate + SBI Spread = EBLR

EBLR ± Risk Premium (based on CIBIL score)

While the repo rate is the same for everyone, the risk premium changes depending on your credit score, income stability, and overall profile.

This is why two borrowers applying at the same time can get different SBI home loan interest rates.

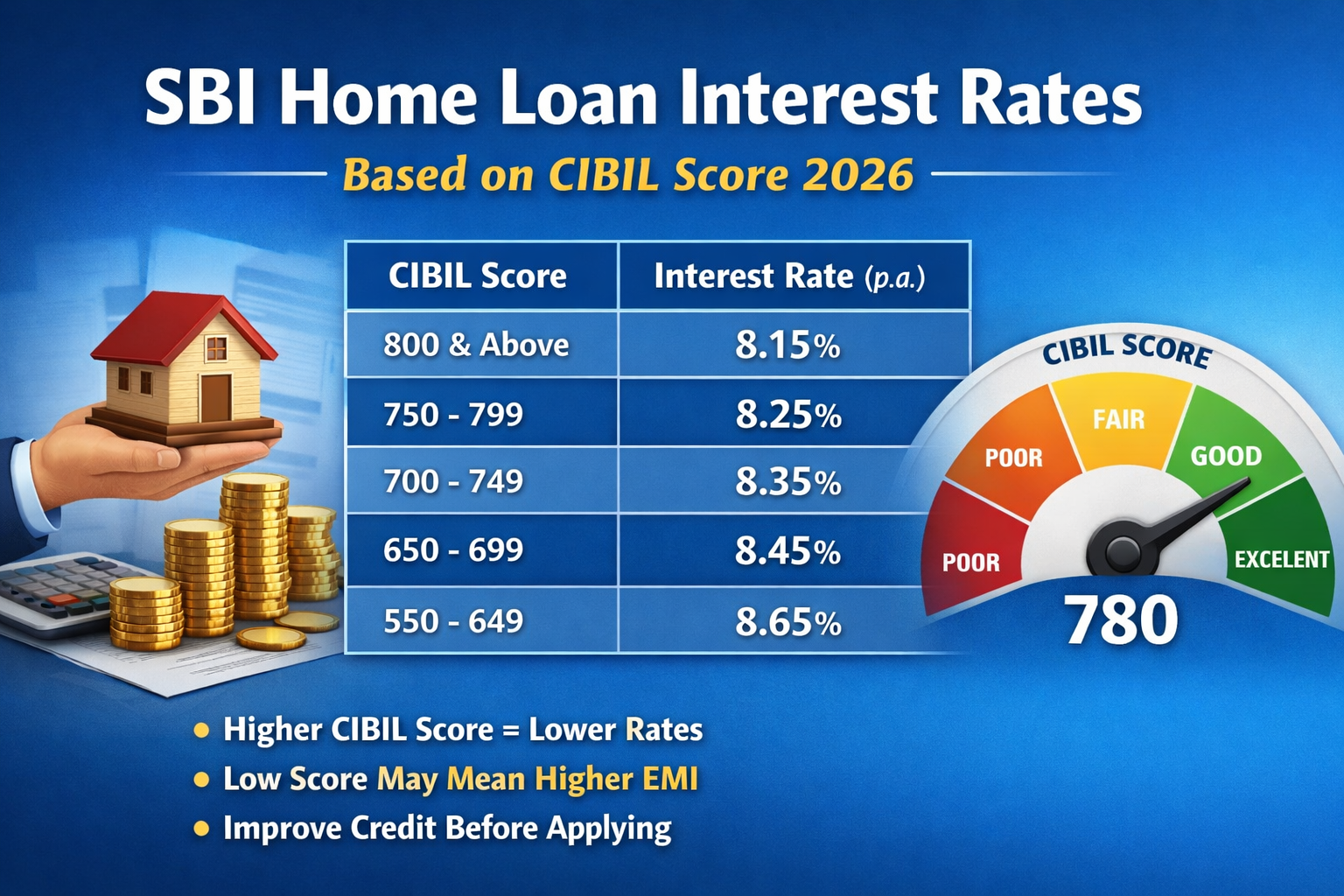

SBI Home Loan Interest Rates Based on CIBIL Score 2026

The table below shows the indicative SBI home loan interest rate structure based on CIBIL score in 2026.

| CIBIL Score Range | Indicative Interest Rate (p.a.) |

|---|---|

| 800 and above | 8.15% |

| 750 – 799 | 8.25% |

| 700 – 749 | 8.35% |

| 650 – 699 | 8.45% |

| 550 – 649 | 8.65% |

| New to Credit / No Score | 8.35% |

These rates are indicative. Final rates may vary depending on RBI repo rate changes, applicant profile, and SBI’s internal assessment.

What Is Considered a Good CIBIL Score for SBI Home Loan?

For SBI home loans in 2026, CIBIL scores are generally interpreted as follows:

- 750 and above – Excellent (best interest rates)

- 700–749 – Good (slightly higher rates)

- 650–699 – Moderate (higher pricing, closer scrutiny)

- Below 650 – Risky (approval becomes difficult)

Borrowers with scores above 750 usually get access to SBI’s lowest interest rate slabs, provided income and property documents are in order.

How Much Difference Does CIBIL Score Make in EMI?

A small difference in interest rate may look insignificant, but over a long tenure, it can have a major cost impact.

Simple Example

- Loan Amount: ₹50 lakh

- Tenure: 25 years

| Interest Rate | Approx EMI |

|---|---|

| 8.15% | ₹39,200 |

| 8.45% | ₹40,200 |

A difference of 0.30% increases EMI by about ₹1,000 per month and adds several lakhs in total interest over the full loan tenure.

SBI Home Loan for Borrowers with No CIBIL Score

Some applicants are new to credit, meaning they have never taken a loan or credit card earlier. In such cases:

- SBI may still approve the home loan

- Interest rates are usually not in the lowest slab

- Greater emphasis is placed on income stability and employer profile

New-to-credit borrowers often get rates similar to the 700–749 score category, provided all other parameters are strong.

Can SBI Reject a Home Loan Due to Low CIBIL Score?

Yes. SBI can reject or delay approval if:

- CIBIL score is very low

- Past defaults remain unresolved

- Recent loan settlements exist

- Multiple overdue accounts appear in the report

However, rejection is not automatic. SBI may still consider applications if:

- There is a strong co-applicant

- Down payment is higher

- Income is stable and well documented

How to Improve Your CIBIL Score Before Applying for SBI Home Loan

If you are planning to apply for an SBI home loan in the next few months, improving your CIBIL score can significantly reduce your interest cost.

Practical Steps

- Pay all EMIs and credit card bills on time

- Keep credit card utilisation below 30%

- Avoid multiple loan or credit enquiries

- Do not settle loans unless unavoidable

- Check your CIBIL report for errors and dispute them

Even a 30–50 point improvement can move you into a lower interest rate slab.

Limitations of CIBIL-Based Pricing

While CIBIL-based pricing improves fairness, it has some limitations:

- Short credit history may work against young borrowers

- Past financial stress can affect current eligibility

- Interest rate benefit is limited if income eligibility is weak

This is why CIBIL score should be seen as one factor, not the only factor.

Using EMI Calculators to Understand Impact

Before applying, borrowers should use home loan EMI calculators to:

- Compare EMI at different interest rates

- Understand long-term interest cost

- Decide comfortable tenure

- Plan prepayments

This helps in making informed decisions rather than relying only on advertised rates.

Expert Conclusion

In 2026, SBI home loan interest rates are closely linked to a borrower’s CIBIL score. This system rewards financial discipline and improves transparency, but it also means borrowers must prepare well before applying.

For applicants with strong credit history, SBI offers some of the most competitive and stable home loan rates in the Indian market. However, improving your CIBIL score before applying can make a meaningful difference to both EMI and total loan cost.

Borrowers should focus on credit health, repayment comfort, and long-term affordability, not just the lowest headline interest rate.

Frequently Asked Questions (FAQs)

1. What CIBIL score is required for SBI home loan in 2026?

SBI generally prefers a CIBIL score of 650 or above, with better rates offered to scores above 750.

2. Can SBI give a home loan without CIBIL score?

Yes, SBI may approve loans for new-to-credit borrowers, but interest rates may be slightly higher.

3. Does SBI offer the same interest rate to all borrowers?

No. SBI follows risk-based pricing, so interest rates vary based on CIBIL score and profile.

4. Can SBI home loan interest rate change during the loan tenure?

Yes. SBI home loans are floating-rate and repo-linked, so rates can change with RBI policy.

5. How much CIBIL score improvement is needed to get a lower rate?

Moving from one slab to another (for example, 700 to 750) can reduce interest rate by 0.10–0.20%.

6. Is CIBIL score more important than income for SBI home loan?

Both are important. A good CIBIL score helps pricing, while income decides eligibility and loan amount.