If you have a home loan, you’ve probably noticed this pattern:

RBI announces a repo rate change → a few weeks later, your home loan EMI changes.

For many borrowers, this feels sudden and confusing.

But in reality, EMI changes are not random – they follow a clear financial logic linked to the RBI repo rate.

In this guide, LoanNestHub breaks it down simply:

- What the RBI repo rate actually is

- How it affects your home loan interest rate and EMI

- What usually changes first – EMI or tenure

- And what smart borrowers do when rates move up or down

Index

- What Is the RBI Repo Rate?

- How Repo Rate Changes Affect Your Home Loan

- EMI vs Tenure: What Actually Changes First?

- Real-Life Example: EMI Impact After a Repo Rate Hike

- Should You Worry About Repo Rate Hikes?

- Fixed vs Floating Home Loans: Should You Switch?

- Smart Ways to Manage Your EMI When Rates Rise

- Final Thoughts: Be Informed, Not Alarmed

What Is the RBI Repo Rate?

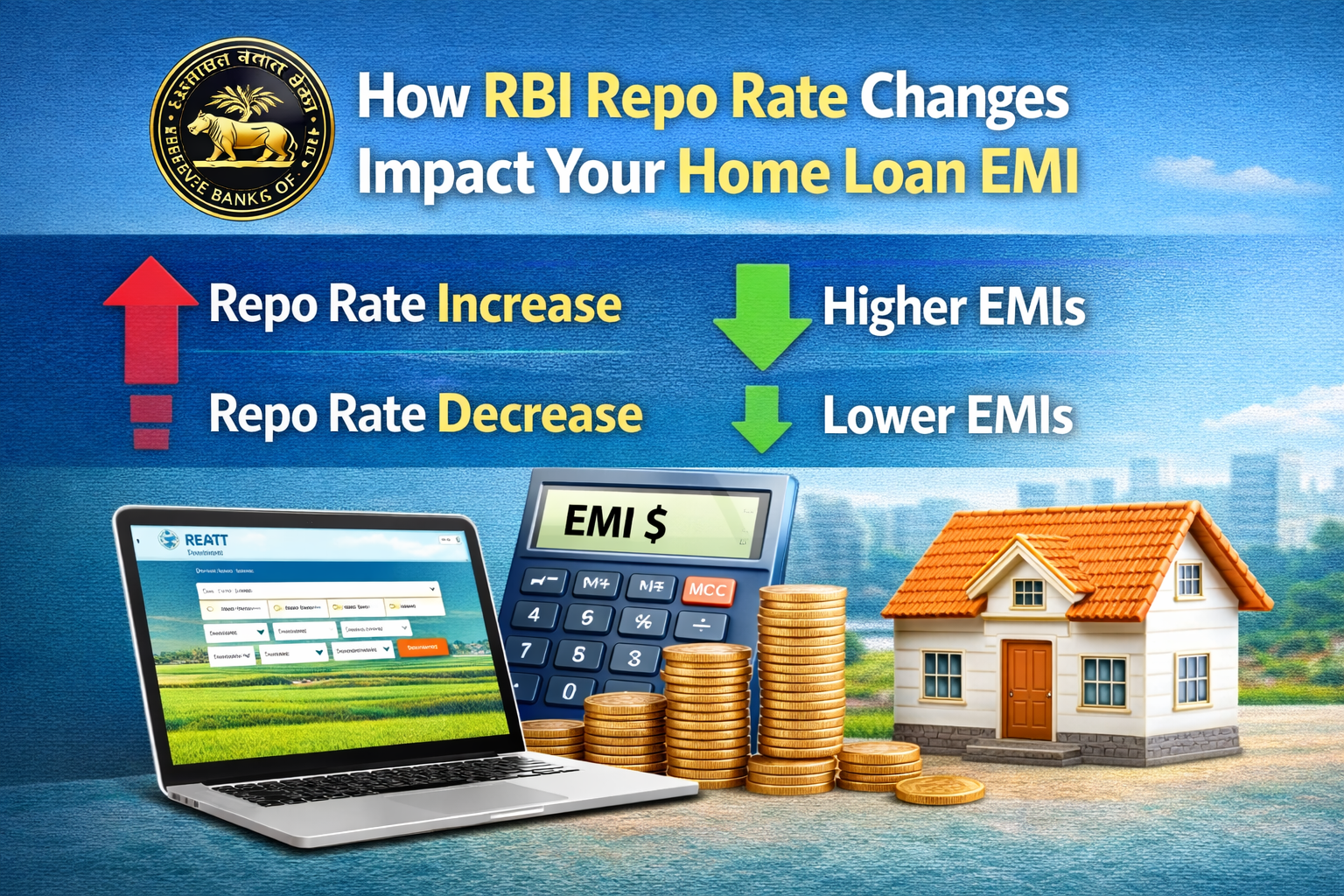

The repo rate is the interest rate at which the Reserve Bank of India lends short-term money to commercial banks.

Think of it as the base cost of money for banks.

- When RBI raises the repo rate → borrowing becomes costlier for banks

- When RBI cuts the repo rate → borrowing becomes cheaper

Banks pass this cost on to customers through loan interest rates – especially home loans.

That’s why the repo rate is often called the master switch for lending rates in India.

How Repo Rate Changes Affect Your Home Loan

Most home loans today are floating-rate loans linked to the repo rate, through a structure called RLLR (Repo Linked Lending Rate).

Your interest rate is calculated like this:

Home Loan Rate = Repo Rate + Bank’s Margin

Example:

- Repo rate: 6.50%

- Bank margin: 2.00%

- Your loan rate: 8.50%

If RBI increases the repo rate to 7.00%, your new loan rate becomes 9.00% and the cost of your loan goes up.

EMI vs Tenure: What Actually Changes First?

This is where many borrowers get confused.

👉 In most cases, banks do NOT immediately increase your EMI.

Instead, they extend your loan tenure to absorb the higher interest.

What usually happens:

- EMI stays the same

- Loan tenure increases

- Total interest paid over time goes up

Only when the tenure hits its maximum limit do banks start increasing the EMI.

This is why repo rate hikes silently make your loan more expensive even if your EMI looks unchanged.

Real-Life Example: EMI Impact After a Repo Rate Hike

Let’s say you have:

- Home loan amount: ₹30 lakh

- Interest rate: 8.5%

- Tenure: 20 years

- EMI: ~₹26,000

Now RBI hikes the repo rate by 0.50%.

Your new rate becomes 9.0%.

Two possible outcomes:

- Tenure increases by 2–3 years

- OR EMI rises to ~₹27,000

Either way, the extra interest paid over the loan life can run into lakhs.

This is why even “small” repo changes matter.

Should You Worry About Repo Rate Hikes?

Not panic – but you should pay attention.

Repo rate changes are driven by:

- Inflation

- Economic growth

- Global interest rate cycles

When inflation is high, RBI tightens rates.

When growth slows, RBI often cuts rates.

For floating-rate borrowers, this means:

- EMIs rise during tightening cycles

- EMIs fall when rates soften

Understanding this cycle helps you plan – instead of reacting late.

Fixed vs Floating Home Loans: Should You Switch?

During rising rate cycles, many borrowers ask:

“Should I switch to a fixed rate?“

Here’s the practical truth:

Fixed Rate Loans

- EMI stays constant

- Higher starting interest rate

- No benefit when rates fall

Floating Rate Loans

- EMI/tenure adjusts with repo rate

- Cheaper in the long run

- More volatility

Switching makes sense only if:

- Rates are expected to rise sharply

- You value predictability over savings

Before switching, always calculate the long-term cost difference.

Smart Ways to Manage Your EMI When Rates Rise

If your home loan becomes costlier after a repo hike, here’s what experienced borrowers do:

1️⃣ Track the Real Impact

Use a Home Loan EMI Calculator to see:

- EMI impact

- Tenure extension

- Total extra interest paid

2️⃣ Make Partial Prepayments

Even small prepayments reduce:

- Principal outstanding

- Interest burden

- Future repo impact

3️⃣ Avoid Blind Tenure Extensions

Longer tenure = higher lifetime interest.

If your income allows, increase EMI slightly instead.

4️⃣ Consider Loan Balance Transfer

If another lender offers:

- Lower margin

- Faster repo transmission

A home loan balance transfer can save lakhs over time.

Final Thoughts: Be Informed, Not Alarmed

RBI repo rate changes may sound like economic jargon, but they have a direct impact on your monthly budget.

The smartest borrowers don’t fear rate changes they understand them.

By knowing:

- How repo rate affects your loan

- When EMI changes vs tenure changes

- What actions reduce long-term interest

You stay in control regardless of what RBI decides next.

At LoanNestHub, our goal is simple:

help you see the full picture of your home loan, not just the EMI.

👉 Want to see how a repo rate change affects your loan?

Use LoanNestHub’s calculators and plan ahead calmly and confidently.

Does repo rate affect existing home loans?

Yes. All repo-linked floating loans adjust when RBI changes the repo rate.

How often does RBI change repo rate?

RBI reviews it during bi-monthly monetary policy meetings.

Can banks delay repo rate cuts?

Transmission is faster now under RLLR, but minor delays can still happen.

Is repo-linked loan better than MCLR?

Yes. Repo-linked loans respond faster to rate cuts and are more transparent.