🏡 Home Loan Affordability Calculator

Discover whether your dream home fits comfortably within your financial reality

Your Financial Profile

Enter your details to understand your true borrowing capacity and financial comfort level.

Enter your details

Fill in your financial details above to receive a personalized affordability assessment and discover if this home is right for you.

Index

What Is a Home Loan Affordability Calculator?

A home loan affordability calculator helps you decide whether a specific home price fits your income comfortably, not just whether a bank may approve the loan.

Unlike basic EMI calculators, LoanNestHub’s affordability tool evaluates:

- Your total EMI burden

- EMI-to-income ratio

- Lifestyle stress risk

- Long-term financial comfort

This makes it a decision tool, not just a math tool.

How Home Loan Affordability Is Calculated

Affordability is determined using these key factors:

- Monthly take-home income

- Existing EMIs (personal loan, car loan, credit cards)

- Property price

- Down payment percentage

- Interest rate & loan tenure

The calculator then computes:

- Loan amount required

- Monthly EMI

- Total EMI vs income ratio

This ratio is the core indicator of financial comfort.

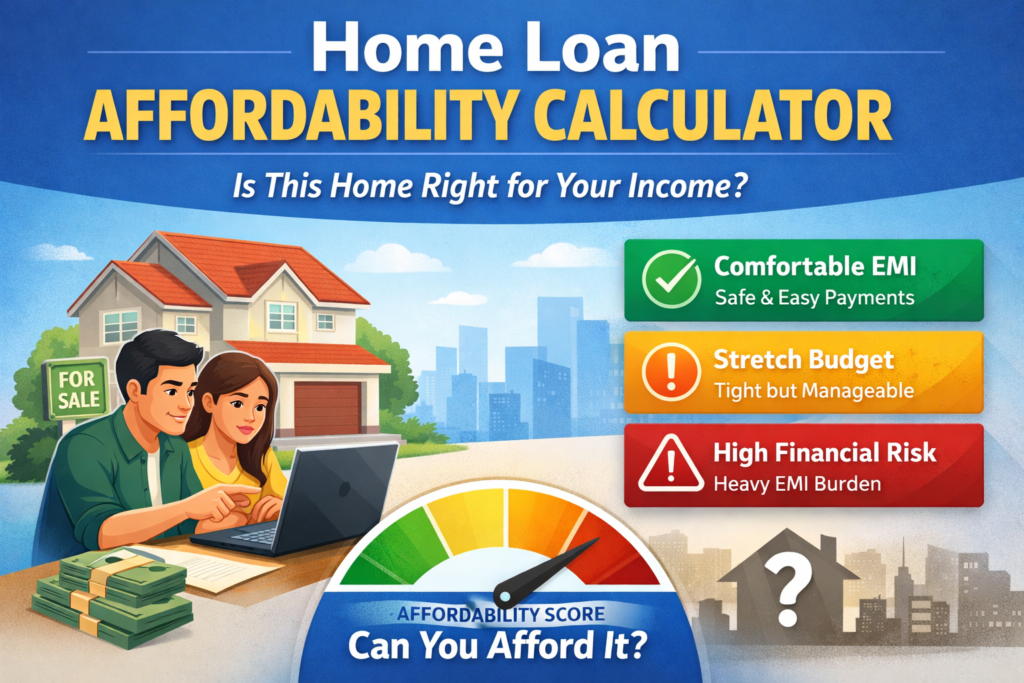

Understanding EMI Comfort Levels

LoanNestHub classifies affordability into three clear outcomes:

- Comfortable (≤30%)

EMI fits well within income, leaving room for savings and emergencies. - Stretch (30–40%)

EMI is manageable but limits lifestyle flexibility. Suitable only with stable income. - Risky (>40%)

EMI consumes too much income and may cause long-term financial stress.

These thresholds are widely used by banks and financial planners.

Why Affordability Matters More Than Eligibility

Many home buyers make the mistake of buying a house based only on:

“Bank ne loan approve kar diya”

Approval does not mean affordability.

Affordability answers the more important question:

“Can I comfortably live with this EMI for the next 20–25 years?“

When Should You Use This Calculator?

Use this affordability calculator:

- Before finalising a property

- Before paying token amount

- When comparing two homes with different prices

- When stretching budget feels tempting

It helps you avoid over-commitment traps that cause stress later.

Important Disclaimer

This calculator is a self-help planning tool. Results are indicative and based on user inputs and assumptions. Actual loan terms may vary by lender and individual profile.

How much EMI is considered affordable for a home loan?

Generally, total EMIs up to 30% of monthly income are considered comfortable. Beyond this, financial stress increases.

Is it risky to take a home loan with 40% EMI?

Yes. EMIs above 40% of income reduce savings, increase dependency on job stability, and limit emergency flexibility.

Does down payment affect affordability?

Yes. Higher down payment reduces loan amount and EMI, making the home more affordable.

Can I afford a home even if the bank approves a higher loan?

Not always. Bank approval considers risk, not your lifestyle comfort.

Should affordability be checked before EMI calculation?

Yes. Affordability should come before EMI fine-tuning and loan optimisation.