Buying a home in India starts with one big question –

“How much money do I need upfront?”

Many first-time buyers focus only on EMI, but the real entry barrier is the down payment.

In this article, we explain:

- What down payment means

- How much is required in 2025

- How banks calculate it

- How you can plan it smartly using a calculator

Index

- What Is a Down Payment?

- Minimum Down Payment Required in 2025

- Example: How Down Payment Works

- Why Banks Ask for Down Payment

- Hidden Costs Buyers Often Forget

- Use a Down Payment Calculator (Smart Move)

- How to Reduce Down Payment Burden

- Down Payment vs EMI – What Should You Prioritize?

- Final Advice for Home Buyers in 2025

- Frequently Asked Questions (FAQ)

- Conclusion

What Is a Down Payment?

A down payment is the part of the property price that you pay from your own pocket.

The bank gives a home loan for the remaining amount.

Simple formula:

Property Price = Down Payment + Home Loan

Banks do not finance 100% of the property value. This rule applies to all banks in India.

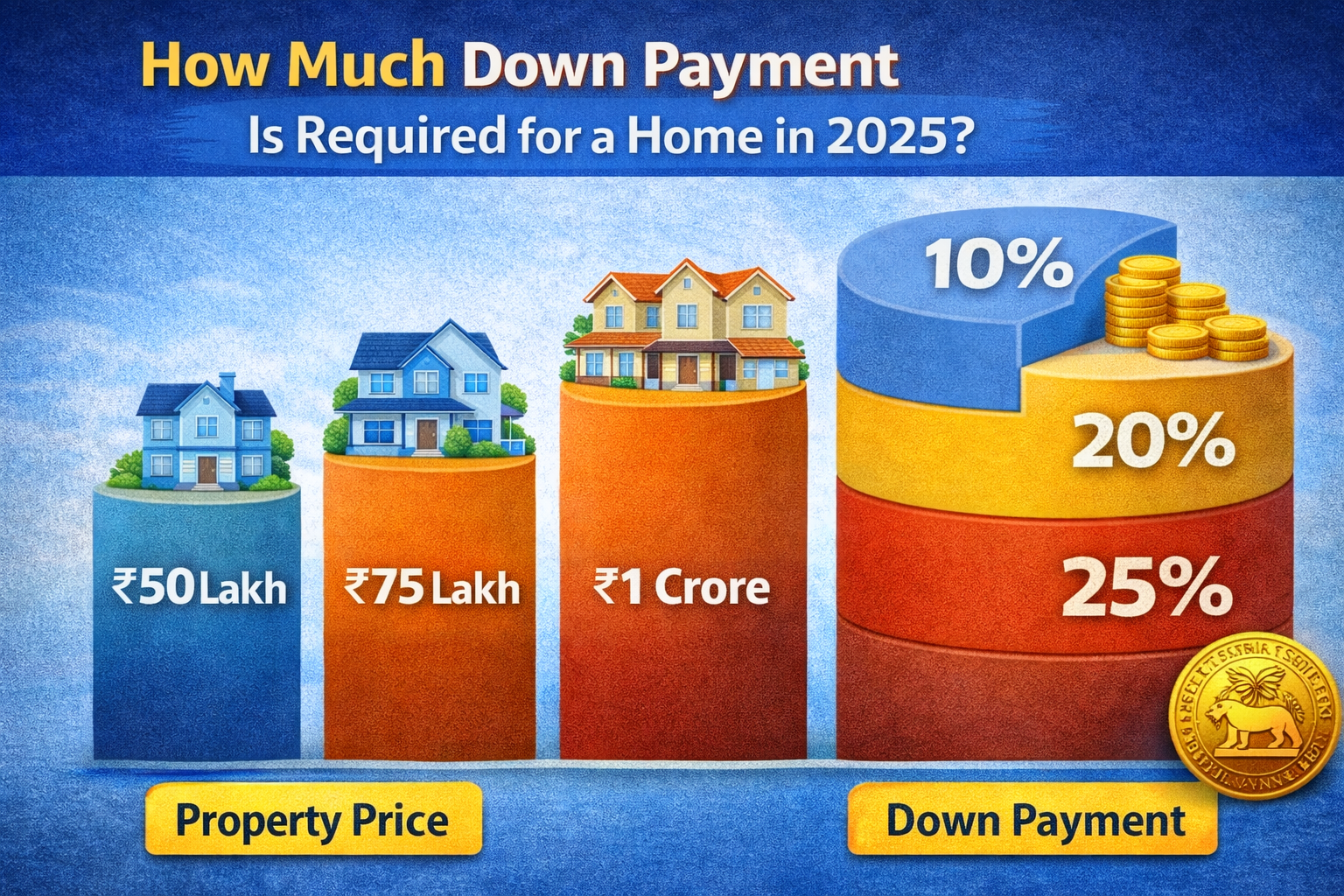

Minimum Down Payment Required in 2025

In 2025, most banks follow RBI guidelines based on property value.

Typical structure:

- Up to ₹30 lakh property

👉 Bank funds up to 90%

👉 Down payment: 10% - ₹30 lakh to ₹75 lakh property

👉 Bank funds up to 80%

👉 Down payment: 20% - Above ₹75 lakh property

👉 Bank funds up to 75%

👉 Down payment: 25%

⚠️ This can vary slightly from bank to bank, but these are standard ranges.

Example: How Down Payment Works

If a flat costs ₹60 lakh:

- Bank funds (80%) → ₹48 lakh

- Your down payment (20%) → ₹12 lakh

This ₹12 lakh must be arranged before loan disbursal.

Why Banks Ask for Down Payment

Banks ask for down payment to:

- Reduce their risk

- Ensure buyer commitment

- Keep EMI affordable for borrowers

A higher down payment also:

- Reduces loan amount

- Lowers EMI

- Decreases total interest paid

Hidden Costs Buyers Often Forget

Down payment is not the only upfront cost.

Also budget for:

- Stamp duty & registration

- GST (for under-construction property)

- Brokerage

- Legal & processing fees

- Interior / moving expenses

👉 This is why planning matters.

Use a Down Payment Calculator (Smart Move)

Instead of guessing, use a Down Payment Calculator.

It helps you:

- Instantly know required upfront cash

- Adjust loan percentage

- Compare different property prices

- Plan savings better

👉 Try our Home Loan Down Payment Calculator to see exact numbers in seconds.

How to Reduce Down Payment Burden

You can manage your down payment better by:

- Choosing a slightly longer loan tenure

- Buying within eligibility limit

- Using savings + FD + mutual fund withdrawals wisely

- Avoiding personal loans for down payment (banks don’t like this)

Down Payment vs EMI – What Should You Prioritize?

- Higher down payment → Lower EMI, less interest

- Lower down payment → Higher EMI, more interest

The right balance depends on:

- Your monthly income

- Job stability

- Emergency savings

There is no “perfect” number – only a comfortable plan.

Final Advice for Home Buyers in 2025

Before booking any property:

1️⃣ Check loan eligibility

2️⃣ Calculate down payment

3️⃣ Decide EMI comfort

4️⃣ Then talk to banks

A few minutes of calculation can save you years of stress.

Frequently Asked Questions (FAQ)

Is down payment mandatory for home loans?

Yes. RBI rules do not allow 100% home loan funding.

Can I use personal loan for down payment?

Banks usually discourage this and may reject the loan if discovered.

Does higher down payment improve approval chances?

Yes. It shows financial discipline and reduces bank risk.

Is down payment different for ready vs under-construction homes?

Loan percentage rules are similar, but GST applies only to under-construction properties.

Conclusion

Down payment is the first real step in your home buying journey.

Plan it carefully, calculate it properly, and never stretch beyond comfort.

👉 Use a down payment calculator and make informed decisions in 2025.